Page 80 - Inbound Logistics | April 2017 | Digital Issue

P. 80

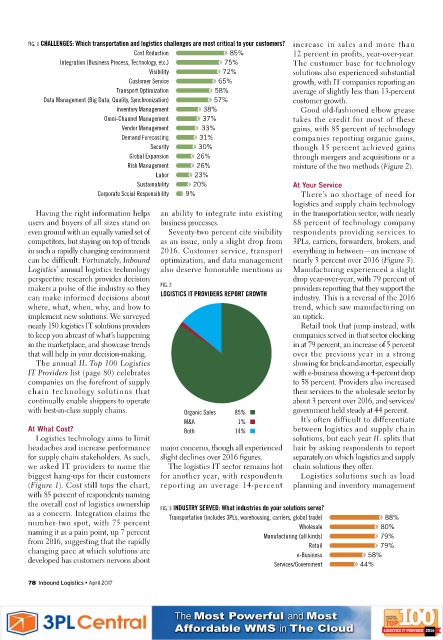

FIG. 1 CHALLENGES: Which transportation and logistics challenges are most critical to your customers? increase in sales and more than

Cost Reduction 840.7= 85% 12 percent in profits, year-over-year.

Integration (Business Process, Technology, etc.) 750.0= 75% The customer base for technology

Visibility 720.2= 72% solutions also experienced substantial

Customer Service 640.6= 65% growth, with IT companies reporting an

Transport Optimization 580.3= 58% average of slightly less than 13-percent

Data Management (Big Data, Quality, Synchronization) 560.9= 57% customer growth.

Inventory Management 380.2= 38% Good old-fashioned elbow grease

Omni-Channel Management 360.8= 37% takes the credit for most of these

Vendor Management 330.3= 33% gains, with 85 percent of technology

Demand Forecasting 310.3= 31% companies reporting organic gains,

Security 290.9= 30% though 15 percent achieved gains

Global Expansion 260.4= 26% through mergers and acquisitions or a

Risk Management 260.4= 26% mixture of the two methods (Figure 2).

Labor 220.9= 23%

Sustainability 200.1= 20% At Your Service

Corporate Social Responsibility 90= 9% There’s no shortage of need for

logistics and supply chain technology

Having the right information helps an ability to integrate into existing in the transportation sector, with nearly

users and buyers of all sizes stand on business processes. 88 percent of technology company

even ground with an equally varied set of Seventy-two percent cite visibility respondents providing services to

competitors, but staying on top of trends as an issue, only a slight drop from 3PLs, carriers, forwarders, brokers, and

in such a rapidly changing environment 2016. Customer service, transport everything in between—an increase of

can be difficult. Fortunately, Inbound optimization, and data management nearly 3 percent over 2016 (Figure 3).

Logistics’ annual logistics technology also deserve honorable mentions as Manufacturing experienced a slight

perspective research provides decision drop year-over-year, with 79 percent of

makers a pulse of the industry so they FIG. 2 providers reporting that they support the

can make informed decisions about LOGISTICS IT PROVIDERS REPORT GROWTH industry. This is a reversal of the 2016

where, what, when, why, and how to trend, which saw manufacturing on

implement new solutions. We surveyed an uptick.

nearly 150 logistics IT solutions providers Retail took that jump instead, with

to keep you abreast of what’s happening companies served in that sector clocking

in the marketplace, and showcase trends in at 79 percent, an increase of 5 percent

that will help in your decision-making. over the previous year in a strong

The annual IL Top 100 Logistics showing for brick-and-mortar, especially

IT Providers list (page 80) celebrates with e-business showing a 4-percent drop

companies on the forefront of supply to 58 percent. Providers also increased

chain technology solutions that their services to the wholesale sector by

continually enable shippers to operate about 3 percent over 2016, and services/

with best-in-class supply chains. Organic Sales 85% n government held steady at 44 percent.

M&A 1% n It’s often difficult to differentiate

At What Cost? Both 14% n between logistics and supply chain

Logistics technology aims to limit solutions, but each year IL splits that

headaches and increase performance major concerns, though all experienced hair by asking respondents to report

for supply chain stakeholders. As such, slight declines over 2016 figures. separately on which logistics and supply

we asked IT providers to name the The logistics IT sector remains hot chain solutions they offer.

biggest hang-ups for their customers for another year, with respondents Logistics solutions such as load

(Figure 1). Cost still tops the chart, reporting an average 14-percent planning and inventory management

with 85 percent of respondents naming

the overall cost of logistics ownership FIG. 3 INDUSTRY SERVED: What industries do your solutions serve?

as a concern. Integration claims the Transportation (includes 3PLs, warehousing, carriers, global trade) 870.5= 88%

number-two spot, with 75 percent Wholesale 790.9= 80%

naming it as a pain point, up 7 percent Manufacturing (all kinds) 790.2= 79%

from 2016, suggesting that the rapidly Retail 790.2= 79%

changing pace at which solutions are e-Business 570.6= 58%

developed has customers nervous about

Services/Government 430.8= 44%

78 Inbound Logistics • April 2017