Page 12 - GSP_Granary_Gateway_OM_Debt

P. 12

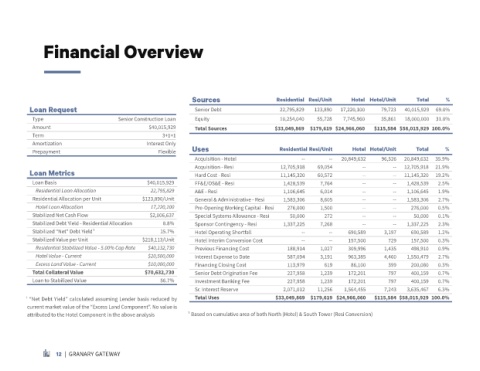

Financial Overview

Sources Residential Resi/Unit Hotel Hotel/Unit Total %

Loan Request Senior Debt 22,795,829 123,890 17,220,100 79,723 40,015,929 69.0%

Type Senior Construction Loan Equity 10,254,040 55,728 7,745,960 35,861 18,000,000 31.0%

Amount $40,015,929 Total Sources $33,049,869 $179,619 $24,966,060 $115,584 $58,015,929 100.0%

Term 3+1+1

Amortization Interest Only

Prepayment Flexible Uses Residential Resi/Unit Hotel Hotel/Unit Total %

Acquisition - Hotel -- -- 20,849,632 96,526 20,849,632 35.9%

Acquisition - Resi 12,705,918 69,054 -- -- 12,705,918 21.9%

Loan Metrics Hard Cost - Resi 11,145,320 60,572 -- -- 11,145,320 19.2%

Loan Basis $40,015,929 FF&E/OS&E - Resi 1,428,539 7,764 -- -- 1,428,539 2.5%

Residential Loan Allocation 22,795,829 A&E - Resi 1,106,645 6,014 -- -- 1,106,645 1.9%

Residential Allocation per Unit $123,890/Unit General & Administrative - Resi 1,583,306 8,605 -- -- 1,583,306 2.7%

Hotel Loan Allocation 17,220,100 Pre-Opening Working Capital - Resi 276,000 1,500 -- -- 276,000 0.5%

Stabilized Net Cash Flow $2,006,637 Special Systems Allowance - Resi 50,000 272 -- -- 50,000 0.1%

Stabilized Debt Yield - Residential Allocation 8.8% Sponsor Contingency - Resi 1,337,225 7,268 -- -- 1,337,225 2.3%

Stabilized "Net" Debt Yield¹ 15.7% Hotel Operating Shortfall -- -- 690,589 3,197 690,589 1.2%

Stabilized Value per Unit $218,113/Unit Hotel Interim Conversion Cost -- -- 157,500 729 157,500 0.3%

Residential Stabilized Value - 5.00% Cap Rate $40,132,730 Previous Financing Cost 188,914 1,027 309,996 1,435 498,910 0.9%

Hotel Value - Current $20,500,000 Interest Expense to Date 587,094 3,191 963,385 4,460 1,550,479 2.7%

Excess Land Value - Current $10,000,000 Financing Closing Cost 113,979 619 86,100 399 200,080 0.3%

Total Collateral Value $70,632,730 Senior Debt Origination Fee 227,958 1,239 172,201 797 400,159 0.7%

Loan to Stabilized Value 56.7% Investment Banking Fee 227,958 1,239 172,201 797 400,159 0.7%

Sr. Interest Reserve 2,071,012 11,256 1,564,455 7,243 3,635,467 6.3%

¹ “Net Debt Yield” calculated assuming Lender basis reduced by Total Uses $33,049,869 $179,619 $24,966,060 $115,584 $58,015,929 100.0%

current market value of the “Excess Land Component”. No value is

attributed to the Hotel Component in the above analysis ¹ Based on cumulative area of both North (Hotel) & South Tower (Resi Conversion)

12 | GRANARY GATEWAY