Page 28 - the latest homebuying guide

P. 28

www.thelateshomebuyingguide.com

How long should I take to pay for my home?

The longer you take to pay off your loan, the more it will cost you

in interest. Longer payment period usually means less in monthly

payments, but you pay more overall.

There are strategies that can be used to pay off your loan early,

especially if there is no penalty to do so in your agreement. Your

individual situation may be the deciding factor however. Speak

with your loan officer to see your options.

The maximum period you will get to pay off your loan is 30 years.

If you can afford the higher monthly payments in a 15-year mort-

gage, then by all means go for it. Your mortgage broker will go

through the options with you so you can make the best choice.

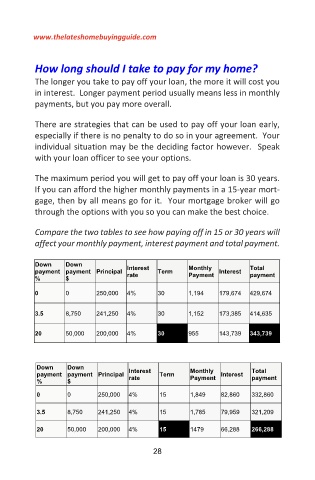

Compare the two tables to see how paying off in 15 or 30 years will

affect your monthly payment, interest payment and total payment.

Down Down

payment payment Principal Interest Term Monthly Interest Total

payment

rate

Payment

% $

0 0 250,000 4% 30 1,194 179,674 429,674

3.5 8,750 241,250 4% 30 1,152 173,385 414,635

20 50,000 200,000 4% 30 955 143,739 343,739

Down Down

payment payment Principal Interest Term Monthly Interest Total

% $ rate Payment payment

0 0 250,000 4% 15 1,849 82,860 332,860

3.5 8,750 241,250 4% 15 1,785 79,959 321,209

20 50,000 200,000 4% 15 1479 66,288 266,288

28