Page 16 - The Latest Homebuying Guide

P. 16

www.thelateshomebuyingguide.com

Qualifying for a mortgage

The best person to answer a question regarding a mortgage is

your mortgage loan officer, who will give you an answer after

assessing your current situation. The qualification process in-

volves an analysis of your credit, income, employment, ability to

take care of downpayment, closing and related expenses, and the

value of the home you are interested in buying. Your income will

be the primary factor in determining the price of the home you

qualify for. Income is used to calculate financial ratios that are

vital for mortgage qualification.

There are four main mortgage programs available to home buyers.

This means that you have ample opportunities to qualify and get

the required financing for your home.

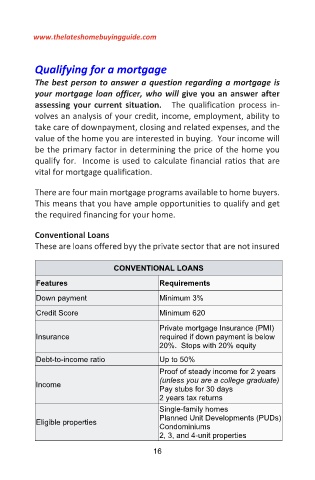

Conventional Loans

These are loans offered byy the private sector that are not insured

CONVENTIONAL LOANS

Features Requirements

Down payment Minimum 3%

Credit Score Minimum 620

Private mortgage Insurance (PMI)

Insurance required if down payment is below

20%. Stops with 20% equity

Debt-to-income ratio Up to 50%

Proof of steady income for 2 years

(unless you are a college graduate)

Income

Pay stubs for 30 days

2 years tax returns

Single-family homes

Planned Unit Developments (PUDs)

Eligible properties

Condominiums

2, 3, and 4-unit properties

16