Page 31 - The Latest Homebuying Guide

P. 31

www.thelateshomebuyingguide.com

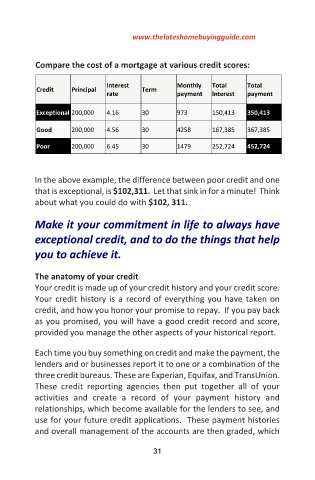

Compare the cost of a mortgage at various credit scores:

Interest Monthly Total Total

Credit Principal Term

rate payment Interest payment

Exceptional 200,000 4.16 30 973 150,413 350,413

Good 200,000 4.56 30 4258 167,385 367,385

Poor 200,000 6.45 30 1479 252,724 452,724

In the above example, the difference between poor credit and one

that is exceptional, is $102,311. Let that sink in for a minute! Think

about what you could do with $102, 311.

Make it your commitment in life to always have

exceptional credit, and to do the things that help

you to achieve it.

The anatomy of your credit

Your credit is made up of your credit history and your credit score.

Your credit history is a record of everything you have taken on

credit, and how you honor your promise to repay. If you pay back

as you promised, you will have a good credit record and score,

provided you manage the other aspects of your historical report.

Each time you buy something on credit and make the payment, the

lenders and or businesses report it to one or a combination of the

three credit bureaus. These are Experian, Equifax, and TransUnion.

These credit reporting agencies then put together all of your

activities and create a record of your payment history and

relationships, which become available for the lenders to see, and

use for your future credit applications. These payment histories

and overall management of the accounts are then graded, which

31