Page 30 - The ultimate homebuyers guide - preview

P. 30

The Latest Home Buying Guide

Step 1 – Put your financial house in order

Lenders are mandated by law to ensure that you satisfy the “Four

C’s of underwriting.” These are:

1. Credit history. This shows your demonstrated responsibility

to manage debt

2. Capacity to repay. Regular income and employment

3. Cash assets. Needed to cover downpayment and closing

cost

4. Collateral. Value of the home you wish to buy.

The first three C’s are totally within your control and that is where

you should start.

Credit History

Credit is your ability to get goods and services now, and pay for

them later. Credit is a powerful financial instrument, and if

managed properly, it can give you a really good financial standing

in life. It can also save you a lot of money in interest, especially on

a mortgage. Used carelessly however, credit can be a nightmare.

It can suck the breath out of your financial standing and cost you

thousands of dollars with higher interest rates.

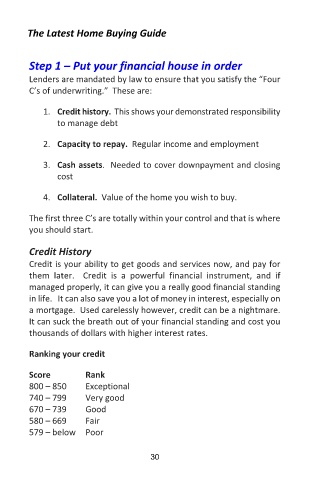

Ranking your credit

Score Rank

800 – 850 Exceptional

740 – 799 Very good

670 – 739 Good

580 – 669 Fair

579 – below Poor

30