Page 100 - 2017-2018 NSE FACTBOOK.cdr

P. 100

2017/2018 NSE FACT BOOK 2017/2018 NSE FACT BOOK

The Performance Documentary of Listed Nigerian Companies The Performance Documentary of Listed Nigerian Companies

MAIN BOARD MAIN BOARD

FIDELITY BANK PLC FINANCIAL SERVICES GUARANTY TRUST BANK PLC FINANCIAL SERVICES

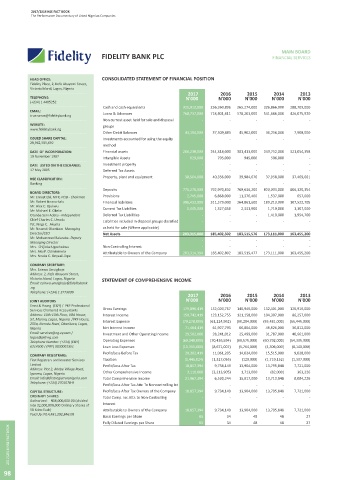

HEAD OFFICE: CONSOLIDATED STATEMENT OF FINANCIAL POSITION HEAD OFFICE: CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Fidelity Place, 2, Kofo Abayomi Street, Plot 635, Akin Adesola Street, Victoria

Victoria Island, Lagos, Nigeria Island, Lagos State.

-------------------------------------------------- 2017 2016 2015 2014 2013 -------------------------------------------------- 2017 2016 2015 2014 2013

TELEPHONE: N'000 N'000 N'000 N'000 N'000 TELEPHONE: N'000 N'000 N'000 N'000 N'000

(+234) 1 4485252 (+234) (1) 2714580-9 ; +(234)

-------------------------------------------------- Cash and cash equivalents 321,912,000 256,260,896 265,274,000 326,866,000 288,709,000 (1)4480740-9 Property, plant and equipment 98,669,998 93,488,055 87,988,778 76,236,447 68,306,197

EMAIL: Loans & Advances 768,737,000 718,401,411 578,203,000 541,686,000 426,075,920 -------------------------------------------------- Intangibles 14,834,954 13,858,906 12,470,612 12,516,219 11,214,274

true.serve@fidelitybank.ng EMAIL:

-------------------------------------------------- Non current asset held for sale and disposal - - - - - enquiries@gtbank.com Inventories - - - - -

WEBSITE: groups -------------------------------------------------- Receivables 27,441,894 19,876,225 14,208,030 15,961,551 16,322,182

www.fidelitybank.ng WEBSITE:

-------------------------------------------------- Other Debit Balances 43,194,000 37,509,883 45,902,000 36,256,000 7,908,000 www.gtbank.com Cash and bank balances 641,973,784 455,863,305 254,633,215 246,939,868 307,395,676

ISSUED SHARE CAPITAL: Investments accounted for using the equity - - - - - -------------------------------------------------- Other financial assets 2,568,176,029 2,533,306,948 2,155,293,074 2,004,222,441 1,699,608,086

28,962,585,692 ISSUED SHARE CAPITAL:

-------------------------------------------------- method N14,715,589,612 Total Assets 3,351,096,659 3,116,393,439 2,524,593,709 2,355,876,526 2,102,846,415

DATE OF INCORPORATION: Financial assets 206,238,000 244,818,000 301,413,000 243,752,000 321,054,358 --------------------------------------------------

19 November 1987 Intangible Assets 629,000 795,000 945,000 506,000 - DATE OF INCORPORATION: Current liabilities 2,512,974,101 2,272,513,665 1,876,070,994 1,720,122,881 1,539,279,760

-------------------------------------------------- 20 July 1990

DATE LISTED ON THE EXCHANGE: Investment property - - - - - -------------------------------------------------- Non-current liabilities 212,954,763 338,976,939 234,960,777 271,039,347 236,571,008

17 May 2005 Deferred Tax Assets - - - - - DATE LISTED ON THE EXCHANGE: Total Liabilities 2,725,928,864 2,611,490,604 2,111,031,771 1,991,162,228 1,775,850,768

-------------------------------------------------- Property, plant and equipment 38,504,000 40,356,000 39,984,676 37,958,000 37,469,681 09 September 1996 Share capital 14,715,590 14,715,590 14,715,590 14,715,590 14,715,590

NSE CLASSIFICATION: --------------------------------------------------

Banking - - - - NSE SECTOR CLASSIFICATION: Share premium 123,471,114 123,471,114 123,471,114 123,471,114 123,471,114

-------------------------------------------------- Deposits 775,276,000 792,970,832 769,636,200 820,034,000 806,320,354 Banking Retained earnings 128,386,206 90,273,587 51,089,585 51,425,181 49,847,719

BOARD DIRECTORS: --------------------------------------------------

Mr. Ernest Ebi, MFR, FCIB - Chairman Provisions 2,745,000 6,868,000 11,376,400 1,537,000 657,000 BOARD OF DIRECTORS: Total Equity 625,167,795 504,902,835 413,561,938 364,714,298 326,995,647

Mr. Robert Nnana-kalu Financial liabilities 396,433,000 311,573,000 264,861,600 189,213,000 107,522,705 Mrs. O. A. Demuren Chairman, Board of Total Liabilities and Equity 3,351,096,659 3,116,393,439 2,524,593,709 2,355,876,526 2,102,846,415

Mr. Alex C. Ojukwu Directors

Current Tax Liabilites 1,445,000 1,327,056 2,331,900 1,719,000 1,307,000

Mr. Michael E. Okeke Mr. J.K.O. Agbaje Managing

Otunba Seni Adetu - Independent Deferred Tax Liabilities - - - 1,410,000 1,954,700 Director/CEO

Chief Charles C. Umolu Liabilities included in disposal groups classified - - - - - Mr. K. A. Adeola Non-Executive Director

Pst. Kings C. Akuma Mr. O. M. Agusto Non-Executive Director CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Mr. Nnamdi Okonkwo- Managing as held for sale (Where applicable) Mr. I. Hassan Non-Executive Director

Director/CEO Net Assets 203,315,000 185,402,302 183,515,576 173,111,000 163,455,200 Mr. H. A. Oyinlola Non-Executive

Mr. Mohammed Balarabe- Deputy Director

Managing Director - - - - - Ms. I. L. Akpofure Non-Executive 2017 2016 2015 2014 2013

Mrs. Chijioke Ugochukwu Non Controlling Interest - - - - - (Independent) Director N'000 N'000 N'000 N'000 N'000

Mrs. Aku P. Odinkemelu Attributable to Owners of the Company 203,314,394 185,402,802 183,515,477 173,111,000 163,455,200 Mr. B. T. Soyoye Non-Executive Gross Earnings 419,226,271 414,615,587 301,850,111 278,520,814 242,665,011

Mrs. Nneka C. Onyeali-ikpe (Independent) Director

-------------------------------------------------- Mrs. V. O. Adefala Non-Executive Profit before tax 200,242,020 165,136,461 120,694,804 116,385,843 107,091,256

COMPANY SECRETARY: (Independent) Director Taxation (29,772,387) (32,855,806) (21,257,923) (21,951,751) (17,067,279)

Mrs. Ezinwa Unuigboje Mr. A. A. Odeyemi Executive Director

Address: 2, Kofo Abayomi Street, Mrs. O. O. Omotola Executive Director Profit after tax 170,469,633 132,280,655 99,436,881 94,434,092 90,023,977

Victoria Island, Lagos, Nigeria STATEMENT OF COMPREHENSIVE INCOME Mr. A. A. Oyedeji Executive Director Transfer to revenue reserve 91,005,449 73,418,297 47,343,694 42,929,528 39,990,972

Email: ezinwa.unuigboje@fidelitybank Mr. H. Musa Executive Director

.ng Mr. J. M. Lawal Executive Director

Telephone: (+234) 1 2773099 -------------------------------------------------- Profit attributable to:

-------------------------------------------------- 2017 2016 2015 2014 2013 COMPANY SECRETARY: owners of the Company 169,602,315 131,341,742 98,678,427 93,739,459 89,599,095

JOINT AUDITORS N'000 N'000 N'000 N'000 N'000 Erhi Obebeduo

Ernst & Young (E&Y) / PKF Professional Address: Plot 635, Akin Adesola Street, Non-controlling interest 867,318 938,913 758,454 694,633 424,882

Services Chartered Accountants Gross Earnings 179,896,419 152,020,767 146,948,000 132,401,000 126,918,000 Victoria Island, Lagos State.

Address: 10th-13th Floor, UBA House, Interest Income 150,742,419 123,152,755 121,158,000 104,307,000 86,257,000 Email: erhi.obebeduo@gtbank.com Earnings per 50k share [k] 603 467 351 332 317

57, Marina, Lagos, Nigeria /PKF House, Interest Expense (79,278,000) (61,224,962) (60,294,000) (55,481,000) (55,445,000) Telephone: (+234)8023089212

205a, Ikorodu Road, Obanikoro, Lagos, -------------------------------------------------- Net assets per 50k share [k] 2,124 1,716 1,405 1,239 1,111

Nigeria Net Interest Income 71,464,419 61,927,793 60,864,000 48,826,000 30,812,000 AUDITORS Pricewaterhousecoopers

Email: services@ng.ey.com / Investment and Other Operating Income 29,502,000 28,241,012 25,499,000 31,787,000 40,661,000 Address: Landmark Towers, 5B Water

lagos@pkf-ng.com Corporation Road, Victoria Island, Lagos

Telephone Number: (+234) (E&Y) Operating Expenses (69,349,000) (70,436,594) (66,575,000) (60,792,000) (54,305,000) State

6314500 / (PKF) 9030001351 Loan Loss Expenses (11,315,000) (8,671,007) (5,764,000) (4,306,000) (8,140,000) Email: enquiry@pwc.com

-------------------------------------------------- Profit/Loss Before Tax 20,302,419 11,061,205 14,024,000 15,515,000 9,028,000 Telephone: (+234) (1) 2711700,

COMPANY REGISTRARS: 2703101;

First Registrars and Investor Services Taxation (1,445,024) (1,327,056) (120,000) (1,719,152) (1,307,000) --------------------------------------------------

Limited Profit/Loss After Tax 18,857,394 9,734,149 13,904,000 13,795,848 7,721,000 COMPANY REGISTRARS:

Address: Plot 2, Abebe Village Road, Datamax Registrars Limited

Iganmu, Lagos, Nigeria Other Comprehensive Income 3,110,000 (3,213,905) 1,713,000 (82,000) 363,226 Address: 2C, Gbagada Phase 1, Lagos

Email: info@firstregistrarsnigeria.com Total Comprehensive Income 21,967,394 6,520,244 15,617,000 13,713,848 8,084,226 State

Telephone: (+234) 2701078-9 Profit/Loss After Tax Attr. To Noncontrolling Int - - - - - Email:

-------------------------------------------------- datamax@datamaxregistrars.com

CAPITAL STRUCTURE: Profit/Loss After Tax Owners of the Company 18,857,394 9,734,149 13,904,000 13,795,848 7,721,000 Telephone:(+234)(1)7120008-11

ORDINARY SHARES Total Comp. Inc.Attr. to Non-Controlling - - - - - --------------------------------------------------

Authorized: N16,000,000:00 (divided CAPITAL STRUCTURE:

Into 32,000,000,000 Ordinary Shares of Interest Authorized: 50,000,000,000 Ordinary

50 Kobo Each) Attributable to Owners of the Company 18,857,394 9,734,149 13,904,000 13,795,848 7,721,000 Shares

Paid Up: N14,481,292,846:00 Paid Up: 29,431,179,224 Ordinary

Basis Earnings per Share 65 34 48 48 27

Shares

Fully Diluted Earnings per Share 65 34 48 48 27

2017/2018 NSE FACTBOOK 2017/2018 NSE FACTBOOK

98 99