Page 125 - 2017-2018 NSE FACTBOOK.cdr

P. 125

2017/2018 NSE FACT BOOK 2017/2018 NSE FACT BOOK

The Performance Documentary of Listed Nigerian Companies The Performance Documentary of Listed Nigerian Companies

n NIGER INSURANCE CO. PLC. FINANCIAL SERVICES PRESTIGE ASSURANCE CO PLC FINANCIAL SERVICES

MAIN BOARD

MAIN BOARD

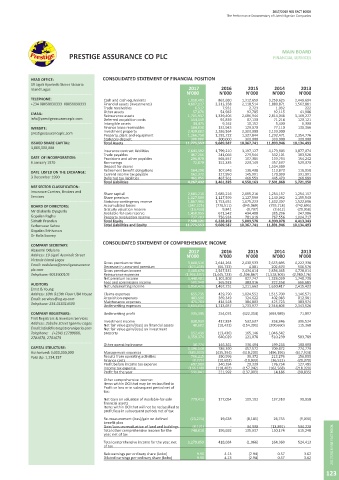

HEAD OFFICEOFFICE: FINANCIAL POSITION SUMMARY HEAD OFFICE: CONSOLIDATED STATEMENT OF FINANCIAL POSITION

48/50, Odunlami Street,lagos Island 19 Ligali Ayorinde Street Victoria

,lagos Island Lagos 2017 2016 2015 2014 2013

-------------------------------------------------- 2016 2015 2014 2013 2012 -------------------------------------------------- N'000 N'000 N'000 N'000 N'000

TELEPHONE: N'000 N'000 N'000 N'000 N'000 TELEPHONE: Cash and cash equivalents 1,010,492 862,680 1,312,659 3,259,625 2,449,694

(234) 01 - 2121262, 01 - 2121264, +234 08058830333 08058890333 Financial assets (investments) 4,607,117 3,313,358 2,118,514 1,880,871 1,562,881

07098126152 Total Assets 22,511,216 20,990,156 22,792,910 24,752,287 22,289,093 -------------------------------------------------- Trade receivables 6,517 7,931 2,723 1,092 222

57,076

51,982

92,705

92,115

41,906

-------------------------------------------------- Total Liabilities 13,898,833 12,322,824 14,436,936 16,579,457 14,938,837 EMAIL: Other assets 1,705,937 1,339,406 2,686,944 2,814,046 3,168,227

Reinsurance assets

EMAIL: Total Equity & Liabilities 22,511,216 20,990,156 22,792,910 24,752,287 22,289,093 info@prestigeassuranceplc.com Deferred acquisition costs 154,149 92,839 87,130 71,216 120,121

info@nigerinsurance.com -------------------------------------------------- Intangible assets 44,475 9,162 10,152 5,400 6,300

-------------------------------------------------- WEBSITE: Finance lease receivables 184,030 132,943 129,070 77,110 130,366

-

WEBSITE: prestigeassuranceplc.com Investment property 2,439,002 2,286,564 2,300,000 2,100,000 2,354,776

1,266,758

1,292,471

1,292,722

Property, plant and equipment

1,327,844

www.nigerinsurance.com -------------------------------------------------- Statutory deposit 300,000 300,000 300,000 300,000 300,000

-------------------------------------------------- ISSUED SHARE CAPITAL: Total Assets 11,775,553 9,689,587 10,367,741 11,893,946 10,134,493

ISSUED SHARE CAPITAL: INCOME STATEMENT SUMMARY 3,000,000,000

7,739,495,702 -------------------------------------------------- Insurance contract liabilities 2,643,592 1,799,210 3,197,127 4,173,905 3,877,074

Trade payables

241,066

467,266

279,544

383,526

532,101

-------------------------------------------------- DATE OF INCORPORATION: Provisions and other payables 295,978 565,557 107,385 103,794 154,242

DATE OF INCORPORATION: 2016 2015 2014 2013 2012 6 January 1970 Borrowings 72,078 152,335 223,149 457,637 529,370

29 August 1962 N'000 N'000 N'000 N'000 N'000 -------------------------------------------------- Deposit for shares - - - 1,504,989 -

-------------------------------------------------- DATE LISTED ON THE EXCHANGE: Retirement benefit obligations 164,290 107,646 136,408 113,873 116,958

391,091

Current income tax payable

127,950

145,991

162,372

170,090

DATE LISTED ON THE EXCHANGE: Gross Written Premium 5,962,510 10,496,777 11,064,824 10,443,205 10,330,471 3 December 1990 Deferred tax liabilities 461,856 467,561 468,559 445,479 268,889

20 August 1990 Gross Premium Income 5,077,874 10,596,991 10,536,131 10,647,316 8,705, 901 -------------------------------------------------- Total Liabilities 4,267,432 3,461,325 4,558,163 7,501,868 5,721,150

-------------------------------------------------- Profit Before Tax 99,045 736,030 644,781 716,108 703,499 NSE SECTOR CLASSIFICATION:

NSE SECTOR CLASSIFICATION: Insurance Carriers, Brokers and

Income Tax Expense (51,371) (129,243) 52,571 (81,940) 82,208 Share capital 2,685,216 2,685,216 2,685,216 1,254,157 1,254,157

Insurance Carriers, Brokers and Services Share premium 1,127,599 1,127,599 1,127,599 1,140,092 1,155,540

Services Profit After Tax 42,134 600,911 690,967 627,425 776,293 -------------------------------------------------- Statutory contingency reserve 1,867,906 1,753,651 1,675,223 1,602,307 1,522,696

-------------------------------------------------- Earnings Per Share BOARD OF DIRECTORS: Accumulated losses (347,325) (776,511) (945,069) (755,718) (742,695)

(3,612)

(9,797)

(13,433)

9,841

BOARD OF DIRECTORS: Mr Olakunle Oyegunle Gratuity valuation reserve 1,450,955 671,542 494,488 385,296 (29,058)

247,986

Available-for-sale reserve

Yusuf Hamisu Abubakar, Oon - Basic 0.54 7.76 8.93 8.04 10.03 Gopalan Raghu Property revaluation reserve 737,203 756,924 781,918 767,556 1,004,717

chairman Sidrath Prandan Total Equity 7,508,121 6,228,262 5,809,578 4,390,078 4,413,343

Dauda Kolapo Adedeji - MD/CEO Sarberswar Sahoo Total Liabilities and Equity 11,775,553 9,689,587 10,367,741 11,891,946 10,134,493

Ibrahim Ramat Hassan - Executive Gopalan Srinivasan

Director (Technical & Marketing) Dr Balla Swamy

Fredrick Ugwuja - Executive Director --------------------------------------------------

(Finance & Corporate Services) COMPANY SECRETARY: CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Justus Clinton Uranta - Director Abayomi Odulana 2017 2016 2015 2014 2013

Olufemi Owopetu (Mrs). -Director Address: 19 Ligali Ayorinde Street N'000 N'000 N'000 N'000 N'000

Ebi Enaholo - Director Victoria Island Lagos

Umaru Hamidu Modibbo – Director Email: aodulana@prestigeassurance Gross premium written 3,808,516 2,614,264 2,430,533 2,653,695 4,222,338

Decrease in unearned premium (423,438) (66,733) 4,081 202,670 506,576

Stephen Dike - Director plc.com Gross premium income 3,385,078 2,547,531 2,434,614 2,856,365 4,728,914

-------------------------------------------------- Telephone: 9053900105 Reinsurance expenses (1,936,597) (1,445,723) (1,506,867) (1,528,306) (2,980,176)

COMPANY SECRETARY: -------------------------------------------------- Net premium income 1,448,481 1,101,808 927,747 1,328,059 1,748,738

666,685

383,916

365,923

322,358

501,948

Taiwo Adewale Otuneye AUDITORS Fees and commission income 1,950,429 1,467,731 1,311,663 1,650,417 2,415,423

Net underwriting income

Address: 48/50,odunlami Street, Ernst & Young

9thfloor, Lagos Island, Lagos Address: 10th &13th Floor UBA House Claims expenses 655,735 429,790 1,024,552 1,515,700 1,146,571

Email: otuneyet@nigerinsurance.com Email: services@ng.ey.com Acquisition expenses 483,596 369,349 324,622 402,983 812,981

Maintenance expenses 475,703 414,518 384,803 425,723 383,974

Telephone: (+234) 08033041502 Telephone: 234-016314500 Underwriting expenses 1,615,034 1,213,657 1,733,977 2,344,406 2,343,526

-------------------------------------------------- --------------------------------------------------

AUDITORS COMPANY REGISTRARS: Underwriting profit 335,395 254,074 (422,314) (693,989) 71,897

SIAO (Chartered Accountants) First Registrars & Investors Services

532,637

358,346

417,824

Address: 18b, Olu Holloway Road, Off Address: 2abebe Street Iganmu Lagos Investment income 830,939 (18,433) (154,391) (200,660) 396,524

115,368

40,602

Net fair value gain/(loss) on financial assets

Alfred Rewane Road, Falomo Ikoyi Email:info@firstregistrarsnigeria.com Net fair value gain/(loss) on investment

Lagos Telephone: (+234) 12799880, property 152,438 (13,436) 165,146 1,046,542 -

Email: www.siao.ng.com 2701078, 2701079 1,359,374 640,029 121,078 510,239 583,789

Telephone: (+234) 774487, -------------------------------------------------- Other operating income 30,774 146,361 336,494 199,233 190,990

08023106422 CAPITAL STRUCTURE: 1,390,148 786,390 457,572 709,472 774,779

-------------------------------------------------- Authorized: 3,000,000,000 Management expenses (683,933) (435,394) (418,200) (496,196) (617,924)

COMPANY REGISTRARS: Paid Up: 1,254,157 Results from operating activities 706,215 350,996 39,372 213,276 156,855

NIC Securities & Trust Ltd Finance costs (8,226) (10,602) (19,033) (36,522) (29,370)

Profit before income tax expense 697,989 340,394 20,339 176,754 127,485

Address: 302/304 Ikorodu Road Income tax expense (166,148) (118,402) (157,342) (162,568) (218,320)

Anthony, Lagos. Profit for the year 531,841 221,992 (137,003) 14,186 (90,835)

Email: nicsectrust@yahoo.com

Telephone: (+234) 08053032712 Other comprehensive income:

Items within OCI that may be reclassified to

-------------------------------------------------- Profit or loss or in subsequent period net of

CAPITAL STRUCTURE: tax:

Authorized: 4,300,000,000

Paid Up: 3,869,739,684 Net Gain on valuation of Available-for-sale 779,413 177,054 109,192 137,310 90,058

financial assets

Items within OCI that will not be reclassified to

profit/loss in subsequent periods net of tax:

Re-measurement (loss)/gain on defined (23,274) 19,638 (8,185) 26,755 (9,030)

benefit plan 748,018 196,692 135,937 (13,891) 534,220

2017/2018 NSE FACTBOOK year, net of tax 1,279,859 418,684 (1,066) 164,360 524,413 2017/2018 NSE FACTBOOK

-

Gain/Loss on revaluation of land and buildings

(8,121)

34,930

615,248

Total other comprehensive income for the

150,174

Total comprehensive income for the year, net

of tax

Baic earnings per ordinary share (kobo)

(2.94)

4.13

3.62

0.57

9.90

3.62

4.13

(2.94)

9.90

Diluted earnings per ordinary share (kobo)

0.57

122 123