Page 27 - BB_Dec_2018SMALL

P. 27

FHA Capital Reserves

Post Healthy Gain, But

HUD Signals No Sign

of a Premium Cut

The Federal Housing Administration (FHA)

today released its annual report to Congress

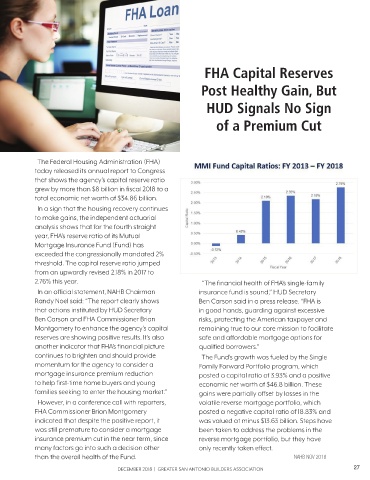

that shows the agency’s capital reserve ratio

grew by more than $8 billion in fiscal 2018 to a

total economic net worth of $34.86 billion.

In a sign that the housing recovery continues

to make gains, the independent actuarial

analysis shows that for the fourth straight

year, FHA’s reserve ratio of its Mutual

Mortgage Insurance Fund (Fund) has

exceeded the congressionally mandated 2%

threshold. The capital reserve ratio jumped

from an upwardly revised 2.18% in 2017 to

2.76% this year. “The financial health of FHA’s single-family

In an official statement, NAHB Chairman insurance fund is sound,” HUD Secretary

Randy Noel said: “The report clearly shows Ben Carson said in a press release. “FHA is

that actions instituted by HUD Secretary in good hands, guarding against excessive

Ben Carson and FHA Commissioner Brian risks, protecting the American taxpayer and

Montgomery to enhance the agency’s capital remaining true to our core mission to facilitate

reserves are showing positive results. It’s also safe and affordable mortgage options for

another indicator that FHA’s financial picture qualified borrowers.”

continues to brighten and should provide The Fund’s growth was fueled by the Single

momentum for the agency to consider a Family Forward Portfolio program, which

mortgage insurance premium reduction posted a capital ratio of 3.93% and a positive

to help first-time home buyers and young economic net worth of $46.8 billion. These

families seeking to enter the housing market.” gains were partially offset by losses in the

However, in a conference call with reporters, volatile reverse mortgage portfolio, which

FHA Commissioner Brian Montgomery posted a negative capital ratio of 18.83% and

indicated that despite the positive report, it was valued at minus $13.63 billion. Steps have

was still premature to consider a mortgage been taken to address the problems in the

insurance premium cut in the near term, since reverse mortgage portfolio, but they have

many factors go into such a decision other only recently taken effect.

than the overall health of the Fund. NAHB NOV 2018

27

DECEMBER 2018 | GREATER SAN ANTONIO BUILDERS ASSOCIATION