Page 14 - BB_May_2019

P. 14

Refinancing Activity

Soars Due to

Rate Declines

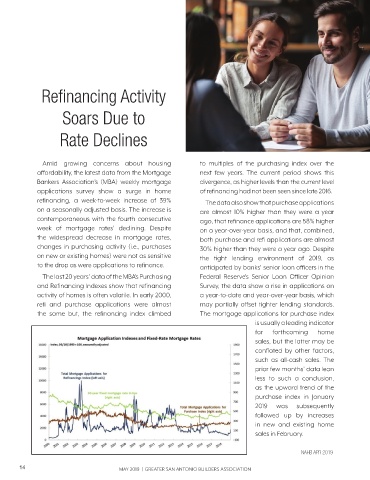

Amid growing concerns about housing to multiples of the purchasing index over the

affordability, the latest data from the Mortgage next few years. The current period shows this

Bankers Association’s (MBA) weekly mortgage divergence, as higher levels than the current level

applications survey show a surge in home of refinancing had not been seen since late 2016.

refinancing, a week-to-week increase of 39% The data also show that purchase applications

on a seasonally adjusted basis. The increase is are almost 10% higher than they were a year

contemporaneous with the fourth consecutive ago, that refinance applications are 58% higher

week of mortgage rates’ declining. Despite on a year-over-year basis, and that, combined,

the widespread decrease in mortgage rates, both purchase and refi applications are almost

changes in purchasing activity (i.e., purchases 30% higher than they were a year ago. Despite

on new or existing homes) were not as sensitive the tight lending environment of 2019, as

to the drop as were applications to refinance. anticipated by banks’ senior loan officers in the

The last 20 years’ data of the MBA’s Purchasing Federal Reserve’s Senior Loan Officer Opinion

and Refinancing Indexes show that refinancing Survey, the data show a rise in applications on

activity of homes is often volatile. In early 2000, a year-to-date and year-over-year basis, which

refi and purchase applications were almost may partially offset tighter lending standards.

the same but, the refinancing index climbed The mortgage applications for purchase index

is usually a leading indicator

for forthcoming home

sales, but the latter may be

conflated by other factors,

such as all-cash sales. The

prior few months’ data lean

less to such a conclusion,

as the upward trend of the

purchase index in January

2019 was subsequently

followed up by increases

in new and existing home

sales in February.

NAHB APR 2019

14 MAY 2019 | GREATER SAN ANTONIO BUILDERS ASSOCIATION