Page 26 - BB_Mar_2019

P. 26

Student Loans

Crowding Out

Home Purchases

Student and auto loans confounding factor that

have historically dominated would overstate the effect of

non-mortgage, non-revolving credit, as student debt on homeownership.

seen in the Federal Reserve’s G.19 Consumer Credit While student debt has increased, credit lending

report. As of the third quarter of 2018, student loan standards have become more stringent after the

debt totaled $1.6 trillion. As student-loan debt has Great Recession., thus providing another impact

historically made up the majority of non-mortgage, on homeownership. To focus on the student loan

non-revolving credit, homeownership is the opportunity impact, the authors limited their sample selection to

cost for its accumulation. In January 2019, as part of 24 – 32 year olds who made home buying decisions

its new Consumer & Community Context series, the prior to 2008.

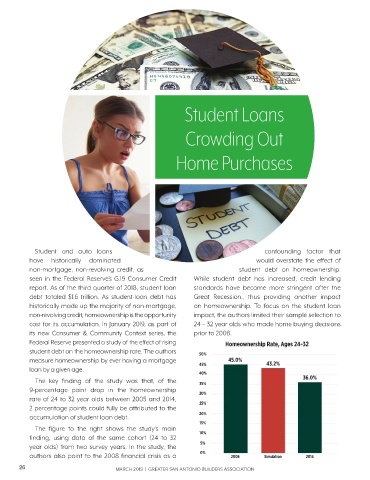

Federal Reserve presented a study of the effect of rising Homeownership Rate, Ages 24-32

student debt on the homeownership rate. The authors

50%

measure homeownership by ever having a mortgage 45.0%

45% 43.2%

loan by a given age.

40%

The key finding of the study was that, of the 35% 36.0%

9-percentage point drop in the homeownership

30%

rate of 24 to 32 year olds between 2005 and 2014,

25%

2 percentage points could fully be attributed to the

20%

accumulation of student loan debt.

15%

The figure to the right shows the study’s main

10%

finding, using data of the same cohort (24 to 32

5%

year olds) from two survey years. In the study, the

0%

authors also point to the 2008 financial crisis as a 2005 Simulation 2014

26 MARCH 2019 | GREATER SAN ANTONIO BUILDERS ASSOCIATION