Page 26 - BB_Apr_2019

P. 26

Increase in

Housing

Wealth

Home owners’ equity in real estate improved as

home prices continue to increase and mortgage

debt expands slowly.

Previous analysis of household balance sheets

from the 2016 Survey of Consumer Finances (SCF)

indicated that the primary residence was the largest

asset category on the balance sheets of households

in 2016 and it accounted for about one quarter of

all assets held by households. For homeowners,

the median amount of primary residence equity,

home equity, rose with age. The Survey of Consumer

Finances (SCF), published by the Board of Governors

of the Federal Reserve System, provides data about

family’s balance sheets every three years. Case-Shiller U.S. National Home Price Index rose by

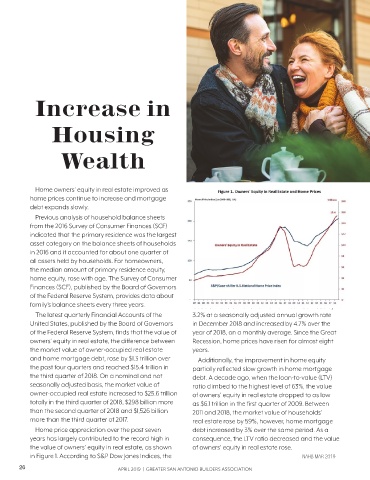

The latest quarterly Financial Accounts of the 3.2% at a seasonally adjusted annual growth rate

United States, published by the Board of Governors in December 2018 and increased by 4.7% over the

of the Federal Reserve System, finds that the value of year of 2018, on a monthly average. Since the Great

owners’ equity in real estate, the difference between Recession, home prices have risen for almost eight

the market value of owner-occupied real estate years.

and home mortgage debt, rose by $1.3 trillion over Additionally, the improvement in home equity

the past four quarters and reached $15.4 trillion in partially reflected slow growth in home mortgage

the third quarter of 2018. On a nominal and not debt. A decade ago, when the loan-to-value (LTV)

seasonally adjusted basis, the market value of ratio climbed to the highest level of 63%, the value

owner-occupied real estate increased to $25.6 trillion of owners’ equity in real estate dropped to as low

totally in the third quarter of 2018, $298 billion more as $6.1 trillion in the first quarter of 2009. Between

than the second quarter of 2018 and $1,526 billion 2011 and 2018, the market value of households’

more than the third quarter of 2017. real estate rose by 59%, however, home mortgage

Home price appreciation over the past seven debt increased by 3% over the same period. As a

years has largely contributed to the record high in consequence, the LTV ratio decreased and the value

the value of owners’ equity in real estate, as shown of owners’ equity in real estate rose.

in Figure 1. According to S&P Dow Jones Indices, the NAHB MAR 2019

26 APRIL 2019 | GREATER SAN ANTONIO BUILDERS ASSOCIATION