Page 24 - BB_Sep_2019

P. 24

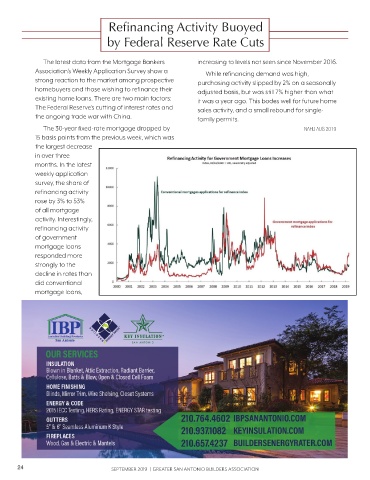

Refinancing Activity Buoyed

by Federal Reserve Rate Cuts

The latest data from the Mortgage Bankers increasing to levels not seen since November 2016.

Association’s Weekly Application Survey show a While refinancing demand was high,

strong reaction to the market among prospective purchasing activity slipped by 2% on a seasonally

homebuyers and those wishing to refinance their adjusted basis, but was still 7% higher than what

existing home loans. There are two main factors: it was a year ago. This bodes well for future home

The Federal Reserve’s cutting of interest rates and sales activity, and a small rebound for single-

the ongoing trade war with China. family permits.

The 30-year fixed-rate mortgage dropped by NAHB AUG 2019

15 basis points from the previous week, which was

the largest decrease

in over three

months. In the latest

weekly application

survey, the share of

refinancing activity

rose by 3% to 53%

of all mortgage

activity. Interestingly,

refinancing activity

of government

mortgage loans

responded more

strongly to the

decline in rates than

did conventional

mortgage loans,

24 SEPTEMBER 2019 | GREATER SAN ANTONIO BUILDERS ASSOCIATION