Page 5 - Benefits Guide

P. 5

Health Care

Medical Coverage

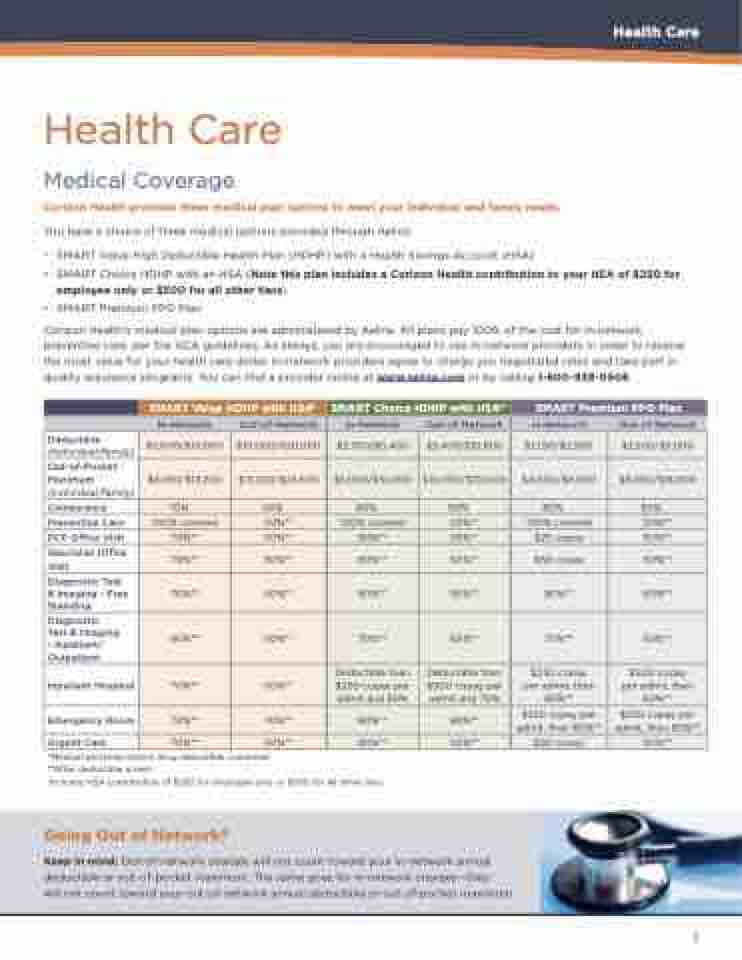

Corizon Health provides three medical plan options to meet your individual and family needs.

You have a choice of three medical options provided through Aetna:

SMART Value High Deductible Health Plan (HDHP) with a Health Savings Account (HSA)

SMART Choice HDHP with an HSA (Note this plan includes a Corizon Health contribution to your HSA of $250 for employee only or $500 for all other tiers)

SMART Premium PPO Plan

Corizon Health’s medical plan options are administered by Aetna. All plans pay 100% of the cost for in-network preventive care, per the ACA guidelines. As always, you are encouraged to use in-network providers in order to receive the most value for your health care dollar. In-network providers agree to charge you negotiated rates and take part in quality assurance programs. You can find a provider online at www.aetna.com or by calling 1-800-938-0508.

Health Care

SMART Value HDHP with HSA*

SMART Choice HDHP with HSA*1

SMART Premium PPO Plan

In-Network

Out-of-Network

In-Network

Out-of-Network

In-Network

Out-of-Network

Deductible

(individual/family)

$5,000/$10,000

$10,000/$20,000

$2,700/$5,400

$5,400/$10,800

$1,250/$2,500

$2,500/$5,000

Out-of-Pocket Maximum (individual/family)

$6,650/$13,200

$13,200/$23,600

$5,000/$10,000

$10,000/$20,000

$4,000/$8,000

$8,000/$16,000

Coinsurance

70%

50%

80%

50%

80%

50%

Preventive Care

100% covered

50%**

100% covered

50%**

100% covered

50%**

PCP Office Visit

70%**

50%**

80%**

50%**

$25 copay

50%**

Specialist Office Visit

70%**

50%**

80%**

50%**

$50 copay

50%**

Diagnostic Test & Imaging - Free Standing

70%**

50%**

80%**

50%**

80%**

50%**

Diagnostic Test & Imaging - Inpatient/ Outpatient

60%**

50%**

70%**

50%**

70%**

50%**

Inpatient Hospital

70%**

50%**

Deductible then $250 copay per admit and 80%

Deductible then $500 copay per admit and 70%

$250 copay per admit, then 80%**

$500 copay per admit, then 50%**

Emergency Room

70%**

70%**

80%**

80%**

$250 copay per admit, then 80%**

$250 copay per admit, then 80%**

Urgent Care

70%**

50%**

80%**

50%**

$50 copay

50%**

*Medical and prescription drug deductible combined

**After deductible is met

1Includes HSA contribution of $250 for employee only or $500 for all other tiers

Going Out of Network?

Keep in mind: Out-of-network charges will not count toward your in-network annual deductible or out-of-pocket maximum. The same goes for in-network charges—they

will not count toward your out-of-network annual deductible or out-of-pocket maximum.

5