Page 56 - cfi-Accounting-eBook

P. 56

The Corporate Finance Institute Accounting

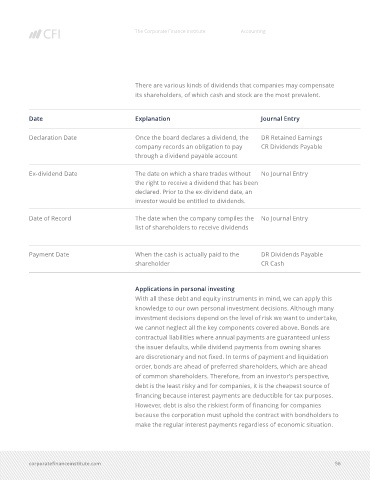

There are various kinds of dividends that companies may compensate

its shareholders, of which cash and stock are the most prevalent.

Date Explanation Journal Entry

Declaration Date Once the board declares a dividend, the DR Retained Earnings

company records an obligation to pay CR Dividends Payable

through a dividend payable account

Ex-dividend Date The date on which a share trades without No Journal Entry

the right to receive a dividend that has been

declared. Prior to the ex-dividend date, an

investor would be entitled to dividends.

Date of Record The date when the company compiles the No Journal Entry

list of shareholders to receive dividends

Payment Date When the cash is actually paid to the DR Dividends Payable

shareholder CR Cash

Applications in personal investing

With all these debt and equity instruments in mind, we can apply this

knowledge to our own personal investment decisions. Although many

investment decisions depend on the level of risk we want to undertake,

we cannot neglect all the key components covered above. Bonds are

contractual liabilities where annual payments are guaranteed unless

the issuer defaults, while dividend payments from owning shares

are discretionary and not fixed. In terms of payment and liquidation

order, bonds are ahead of preferred shareholders, which are ahead

of common shareholders. Therefore, from an investor’s perspective,

debt is the least risky and for companies, it is the cheapest source of

financing because interest payments are deductible for tax purposes.

However, debt is also the riskiest form of financing for companies

because the corporation must uphold the contract with bondholders to

make the regular interest payments regardless of economic situation.

corporatefinanceinstitute.com 56