Page 27 - Signs 365 Benefits Booklet

P. 27

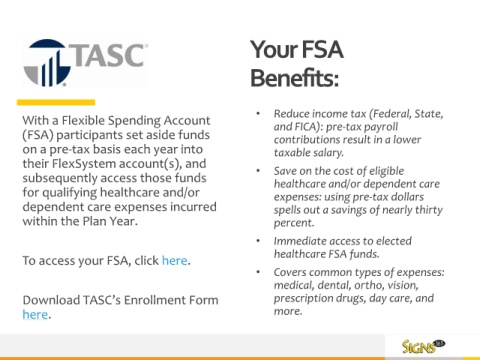

Your FSA

Benefits:

• Reduce income tax (Federal, State,

With a Flexible Spending Account and FICA): pre-tax payroll

(FSA) participants set aside funds contributions result in a lower

on a pre-tax basis each year into taxable salary.

their FlexSystem account(s), and • Save on the cost of eligible

subsequently access those funds healthcare and/or dependent care

for qualifying healthcare and/or expenses: using pre-tax dollars

dependent care expenses incurred spells out a savings of nearly thirty

within the Plan Year. percent.

• Immediate access to elected

healthcare FSA funds.

To access your FSA, click here.

• Covers common types of expenses:

medical, dental, ortho, vision,

Download TASC’s Enrollment Form prescription drugs, day care, and

here. more.