Page 14 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 14

(ii) A resident setting up a joint venture in India in collaboration with a non-resident; or

a wholly owned subsidiary Indian company, of which the holding company is a

foreign company; or a joint venture in India; or

(iii) A resident falling within any such class or category of persons as notified by the

Government of India, to seek in advance, a ruling from the Authority for Advance

Rulings.

(iv) All of the above

A-36: iv - All of the above

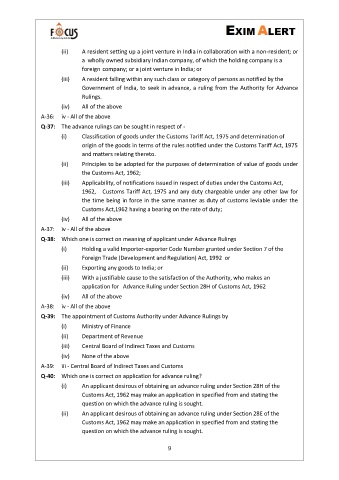

Q-37: The advance rulings can be sought in respect of -

(i) Classification of goods under the Customs Tariff Act, 1975 and determination of

origin of the goods in terms of the rules notified under the Customs Tariff Act, 1975

and matters relating thereto.

(ii) Principles to be adopted for the purposes of determination of value of goods under

the Customs Act, 1962;

(iii) Applicability, of notifications issued in respect of duties under the Customs Act,

1962, Customs Tariff Act, 1975 and any duty chargeable under any other law for

the time being in force in the same manner as duty of customs leviable under the

Customs Act,1962 having a bearing on the rate of duty;

(iv) All of the above

A-37: iv - All of the above

Q-38: Which one is correct on meaning of applicant under Advance Rulings

(i) Holding a valid Importer-exporter Code Number granted under Section 7 of the

Foreign Trade (Development and Regulation) Act, 1992 or

(ii) Exporting any goods to India; or

(iii) With a justifiable cause to the satisfaction of the Authority, who makes an

application for Advance Ruling under Section 28H of Customs Act, 1962

(iv) All of the above

A-38: iv - All of the above

Q-39: The appointment of Customs Authority under Advance Rulings by

(i) Ministry of Finance

(ii) Department of Revenue

(iii) Central Board of Indirect Taxes and Customs

(iv) None of the above

A-39: iii - Central Board of Indirect Taxes and Customs

Q-40: Which one is correct on application for advance ruling?

(i) An applicant desirous of obtaining an advance ruling under Section 28H of the

Customs Act, 1962 may make an application in specified from and stating the

question on which the advance ruling is sought.

(ii) An applicant desirous of obtaining an advance ruling under Section 28E of the

Customs Act, 1962 may make an application in specified from and stating the

question on which the advance ruling is sought.

9