Page 195 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 195

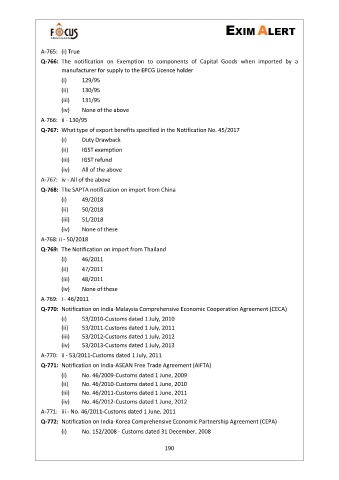

A-765: (i) True

Q-766: The notification on Exemption to components of Capital Goods when imported by a

manufacturer for supply to the EPCG Licence holder

(i) 129/95

(ii) 130/95

(iii) 131/95

(iv) None of the above

A-766: ii - 130/95

Q-767: What type of export benefits specified in the Notification No. 45/2017

(i) Duty Drawback

(ii) IGST exemption

(iii) IGST refund

(iv) All of the above

A-767: iv - All of the above

Q-768: The SAPTA notification on import from China

(i) 49/2018

(ii) 50/2018

(iii) 51/2018

(iv) None of these

A-768: ii - 50/2018

Q-769: The Notification on import from Thailand

(i) 46/2011

(ii) 47/2011

(iii) 48/2011

(iv) None of these

A-769: i - 46/2011

Q-770: Notification on India-Malaysia Comprehensive Economic Cooperation Agreement (CECA)

(i) 53/2010-Customs dated 1 July, 2010

(ii) 53/2011-Customs dated 1 July, 2011

(iii) 53/2012-Customs dated 1 July, 2012

(iv) 53/2013-Customs dated 1 July, 2013

A-770: ii - 53/2011-Customs dated 1 July, 2011

Q-771: Notification on India-ASEAN Free Trade Agreement (AIFTA)

(i) No. 46/2009-Customs dated 1 June, 2009

(ii) No. 46/2010-Customs dated 1 June, 2010

(iii) No. 46/2011-Customs dated 1 June, 2011

(iv) No. 46/2012-Customs dated 1 June, 2012

A-771: iii - No. 46/2011-Customs dated 1 June, 2011

Q-772: Notification on India-Korea Comprehensive Economic Partnership Agreement (CEPA)

(i) No. 152/2008 - Customs dated 31 December, 2008

190