Page 56 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 56

(iv) All of the above

A-187: iv - All of the above

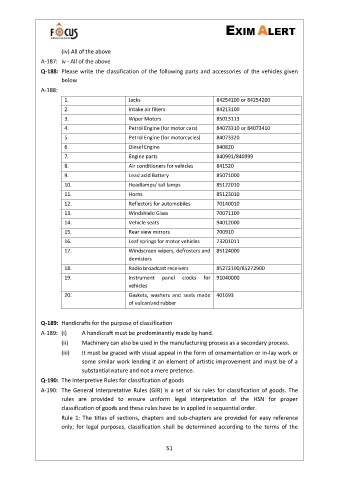

Q-188: Please write the classification of the following parts and accessories of the vehicles given

below

A-188:

1. Jacks 84254100 or 84254200

2. Intake air filters 84213100

3. Wiper Motors 85013113

4. Petrol Engine (for motor cars) 84073310 or 84073410

5. Petrol Engine (for motorcycles) 84073320

6. Diesel Engine 840820

7. Engine parts 840991/840999

8. Air conditioners for vehicles 841520

9. Lead acid Battery 85071000

10. Headlamps/ tail lamps 85122010

11. Horns 85123010

12. Reflectors for automobiles 70140010

13. Windshield Glass 70071100

14. Vehicle seats 94012000

15. Rear view mirrors 700910

16. Leaf springs for motor vehicles 73201011

17. Windscreen wipers, defrosters and 85124000

demisters

18. Radio broadcast receivers 85272100/85272900

19. Instrument panel clocks for 91040000

vehicles

20. Gaskets, washers and seals made 401693

of vulcanized rubber

Q-189: Handicrafts for the purpose of classification

A-189: (i) A handicraft must be predominantly made by hand.

(ii) Machinery can also be used in the manufacturing process as a secondary process.

(iii) It must be graced with visual appeal in the form of ornamentation or in-lay work or

some similar work lending it an element of artistic improvement and must be of a

substantial nature and not a mere pretence.

Q-190: The Interpretive Rules for classification of goods

A-190: The General Interpretative Rules (GIR) is a set of six rules for classification of goods. The

rules are provided to ensure uniform legal interpretation of the HSN for proper

classification of goods and these rules have be in applied in sequential order.

Rule 1: The titles of sections, chapters and sub-chapters are provided for easy reference

only; for legal purposes, classification shall be determined according to the terms of the

51