Page 120 - A Canuck's Guide to Financial Literacy 2020

P. 120

120

CPP Survivor's Pension

The survivor of the deceased contributor who meets the qualifications may be eligible for a

survivor's pension.

The value and timing of the payments depend on

• whether you are younger or older than age 65

• how much, and for how long, the deceased contributor has paid into the CPP

The CPP first calculates what the retirement pension would have been of the deceased had

the individual been age 65 at time of death. A further revision is then made based on the

survivor's age at time of death.

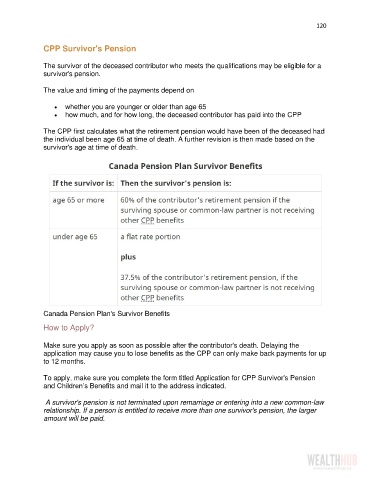

Canada Pension Plan's Survivor Benefits

How to Apply?

Make sure you apply as soon as possible after the contributor's death. Delaying the

application may cause you to lose benefits as the CPP can only make back payments for up

to 12 months.

To apply, make sure you complete the form titled Application for CPP Survivor's Pension

and Children’s Benefits and mail it to the address indicated.

A survivor's pension is not terminated upon remarriage or entering into a new common-law

relationship. If a person is entitled to receive more than one survivor's pension, the larger

amount will be paid.