Page 158 - A Canuck's Guide to Financial Literacy 2020

P. 158

158

▪ Herd Mentality

Also known as the mob mentality which encourages people to act or adopt the same

similar behaviors as people around them. When it comes to investing, always be

aware of your herd instinct. Make sure you do your own analysis when it comes to

investments. Herd mentalities have been known to cause substantial market rallies

and extensive sell offs, often on a lack of fundamental support to justify either.

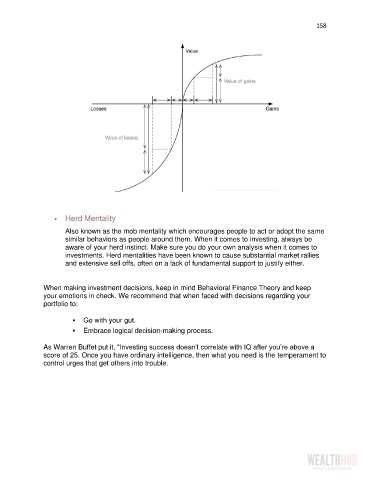

When making investment decisions, keep in mind Behavioral Finance Theory and keep

your emotions in check. We recommend that when faced with decisions regarding your

portfolio to:

▪ Go with your gut.

▪ Embrace logical decision-making process.

As Warren Buffet put it, “Investing success doesn’t correlate with IQ after you’re above a

score of 25. Once you have ordinary intelligence, then what you need is the temperament to

control urges that get others into trouble.