Page 169 - A Canuck's Guide to Financial Literacy 2020

P. 169

169

Probate

Probate is the legal process where the will goes through provincial courts in order to get

certified and validated. The executor would apply for Letters of Probate and confirm that the

will is the last will and testament of the deceased. Upon being granted letters of probate,

property can be transferred onto the name of the executor of which they can begin the

process of settling the estate to the beneficiaries.

The probate process involves fees based on the value of the estate and the fees vary from

province to province. For example, in Ontario, effective January 1st 2020, the probate fees

are $15 for every $1,000 which is applied only to estates with a value of $50,000 and

above.

Probate is not a legislative requirement as certain estates may be settled without probate

but certain situations may call for it such as:

▪ Intestacy

▪ In case of no will, the probate process would confirm the executor of the estate

by granting a “letter of administration” or “certificate of appointment” upon which

the total value of the estate would be subject to probate fees.

▪ In terms of who can be appointed as administrator, it can be a spouse, children

or grand children or any other person appointed by the courts.

▪ Litigation

▪ In cases where the estate is pending litigation due to claims on the estate or

challenges to the will, probate would be necessary.

▪ Real Estate

▪ If property is registered in the land registry agencies then probate is

recommended.

▪ Assets held with financial institutions

▪ Banks will not release assets held with them if the value of the accounts are

above a certain level. They would require a certificate of appointment or a grant

of probate.

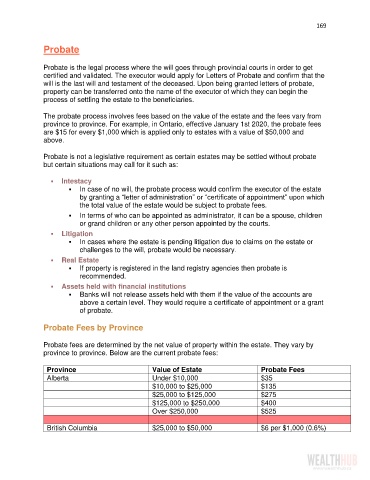

Probate Fees by Province

Probate fees are determined by the net value of property within the estate. They vary by

province to province. Below are the current probate fees:

Province Value of Estate Probate Fees

Alberta Under $10,000 $35

$10,000 to $25,000 $135

$25,000 to $125,000 $275

$125,000 to $250,000 $400

Over $250,000 $525

British Columbia $25,000 to $50,000 $6 per $1,000 (0.6%)