Page 212 - A Canuck's Guide to Financial Literacy 2020

P. 212

212

If a member financial institution fails, the CDIC will contact you and reimburse your insured

funds with interest included. It’s important that your contact information is kept up to date

and CDIC is able to reach you.

GIC Laddering

To reduce interest rate sensitivity among GICs, investors could embrace a GIC laddering

strategy. This strategy could maximize the GIC returns while not locking all of your funds

into a single GIC.

1. The strategy involves dividing your money into 5 different portions. Each portion

would be invested and locked in for a specific number of years at the stated interest

rate.

2. Upon the maturity of the first GIC, the funds can be either re-invested in another 5

year rolling GIC or withdrawn at your convenience.

3. The investment and lock up periods could be crafted in a way that you’re comfortable

with. For this example, we used a 5-year strategy.

Benefits of GIC Laddering

1. Higher Interest Rates – Through laddering your GICs, you may be able to invest in

higher interest rates especially in a rising rate environment.

2. Less Sensitivity to Interest Rates – When rates are rising, your funds can be

reinvested in higher rates GICs. In times of falling rates, you’ve managed to lock

yourself at higher interest rates.

3. Access to Funds – As each GIC matures, you’re able to decide if you want to

withdraw the funds or keep re-investing them into another 5-year GIC.

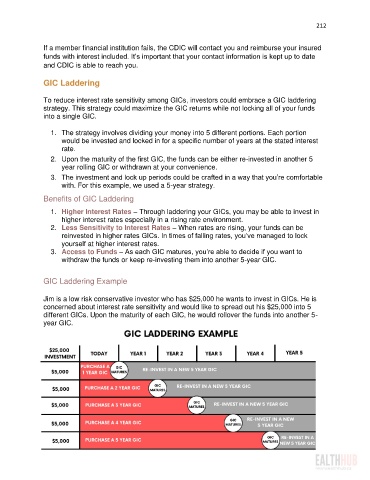

GIC Laddering Example

Jim is a low risk conservative investor who has $25,000 he wants to invest in GICs. He is

concerned about interest rate sensitivity and would like to spread out his $25,000 into 5

different GICs. Upon the maturity of each GIC, he would rollover the funds into another 5-

year GIC.