Page 228 - A Canuck's Guide to Financial Literacy 2020

P. 228

228

Benefits to the Institutions

▪ New Capital – Institutions are able to raise capital at rates that would be considered

more affordable than if they were to go through a commercial bank. Rates may be

fixed or variable, aligned to the prime rate.

▪ Clean Balance Sheet – By pooling loans, institutions are able to clean their balance

sheet by freeing up cash sitting idle and remove the risk of debt.

▪ Enhanced Liquidity – By removing the risk of debt and turning it liquid, the institutions

are still able to earn income by lending the capital back out to new borrowers or

interested investors.

Benefits to the Investor

▪ Choice for the Investor – Asset backed securities allow the investor to choose

exposure to specific sectors in the economy. In addition to home equity loan

payments, an investor can choose to purchase ABS that are related to proceeds from

car loans, equipment leases, student loans, etc.

▪ No Intermediary Risk – An investor would not have to worry about the risk profile that

the institution has bundled up together in an asset backed security. Even if the

institution were to go into default, the income stream would be unaffected thus not

exposing you to the risk profile of an intermediary.

▪ Higher Yields – Asset backed securities tend to offer higher yields than comparable T-

bills or yields that are similar to corporate bonds and mortgage backed securities.

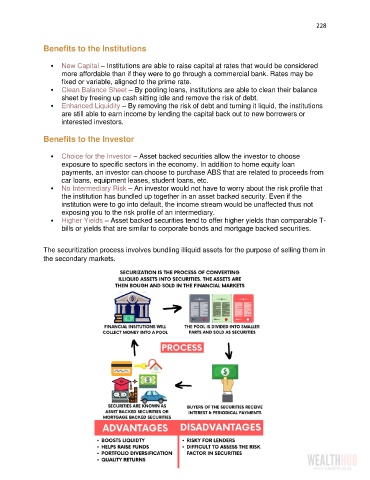

The securitization process involves bundling illiquid assets for the purpose of selling them in

the secondary markets.