Page 236 - A Canuck's Guide to Financial Literacy 2020

P. 236

236

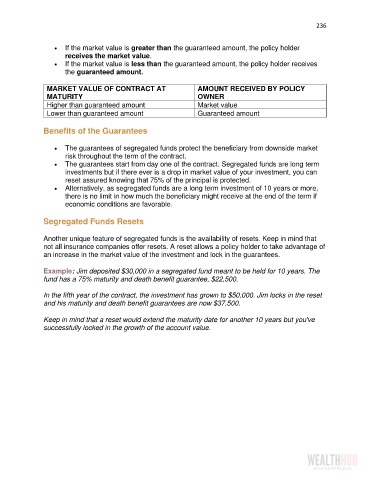

• If the market value is greater than the guaranteed amount, the policy holder

receives the market value.

• If the market value is less than the guaranteed amount, the policy holder receives

the guaranteed amount.

MARKET VALUE OF CONTRACT AT AMOUNT RECEIVED BY POLICY

MATURITY OWNER

Higher than guaranteed amount Market value

Lower than guaranteed amount Guaranteed amount

Benefits of the Guarantees

• The guarantees of segregated funds protect the beneficiary from downside market

risk throughout the term of the contract.

• The guarantees start from day one of the contract. Segregated funds are long term

investments but if there ever is a drop in market value of your investment, you can

reset assured knowing that 75% of the principal is protected.

• Alternatively, as segregated funds are a long term investment of 10 years or more,

there is no limit in how much the beneficiary might receive at the end of the term if

economic conditions are favorable.

Segregated Funds Resets

Another unique feature of segregated funds is the availability of resets. Keep in mind that

not all insurance companies offer resets. A reset allows a policy holder to take advantage of

an increase in the market value of the investment and lock in the guarantees.

Example: Jim deposited $30,000 in a segregated fund meant to be held for 10 years. The

fund has a 75% maturity and death benefit guarantee, $22,500.

In the fifth year of the contract, the investment has grown to $50,000. Jim locks in the reset

and his maturity and death benefit guarantees are now $37,500.

Keep in mind that a reset would extend the maturity date for another 10 years but you've

successfully locked in the growth of the account value.