Page 11 - Delta Chi - Georgia Tech - Campaign Advance Packet

P. 11

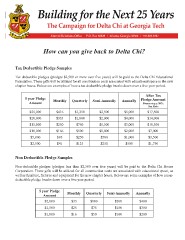

How can you give back to Delta Chi? Tax Deductible Pledge Samples Tax deductible pledges (pledges $2,500 or more over fve years) will be paid to the Delta Chi Educational Foundation. These gifts will be utilized for all construction costs associated with educational space in the new chapter house. Below are examples of how a tax deductible pledge breaks down over a fve year period. After Tax 5 year Pledge Monthly Quarterly Semi-Annually Annually Pledge Amount Amount Presuming a 30% Tax Rate $25,000 $416 $1,250 $2,500 $5,000 $17,500 $20,000 $333 $1,000 $2,000 $4,000 $14,000 $15,000 $250 $750 $1,500 $3,000 $10,500 $10,000 $166 $500 $1,000 $2,000 $7,000 $5,000 $83 $250 $500 $1,000 $3,500 $2,500 $41 $125 $250 $500 $1,750 Non Deductible Pledge Samples Non-deductible pledges (pledges less than $2,500 over fve years) will be paid to the Delta Chi House Corporation. These gifts will be utilized for all construction costs not associated with educational space, as well as furniture, fxtures and equipment for the new chapter house. Below are some examples of how a non- deductible pledge breaks down over a fve year period. 5 year Pledge Monthly Quarterly Semi-Annually Annually Amount $2,000 $33 $100 $200 $400 $1,500 $25 $75 $150 $300 $1,000 $16 $50 $100 $200