Page 125 - Demo

P. 125

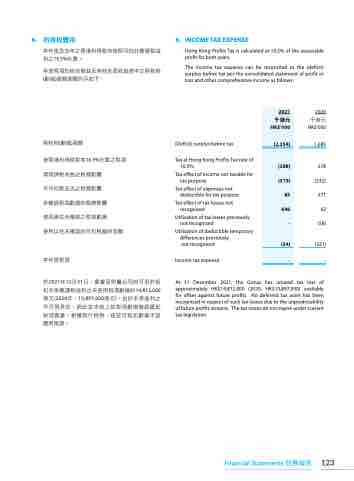

6. 所得稅費用 本年度及去年之香港利得稅均按照可估計應課稅溢

利之16.5%計算。 年度稅項於綜合損益及其他全面收益表中之除稅前

(虧損)盈餘調整列示如下:

除稅前(虧損)盈餘 按香港利得稅稅率16.5%計算之稅項

毋須課稅收益之稅務影響

不可扣稅支出之稅務影響

未確認稅項虧損的稅務影響

使用過往未確認之稅項虧損

使用以往未確認的可扣稅臨時差額

本年度稅項

於2021年12月31日,貴會及附屬公司的可用於抵 扣未來應課稅溢利之未使用稅項虧損約14,812,000 港元(2020年:10,897,000港元)。由於未來溢利之 不可預見性,因此並未就上述稅項虧損確認遞延 稅項資產。根據現行稅例,這些可抵扣虧損不設 應用限期。

6. INCOME TAX EXPENSE

Hong Kong Profits Tax is calculated at 16.5% of the assessable profit for both years.

The income tax expense can be reconciled to the (deficit) surplus before tax per the consolidated statement of profit or loss and other comprehensive income as follows:

2020

千港元

HK$'000 (Deficit) surplus before tax 1,685

Tax at Hong Kong Profits Tax rate of

16.5% 278

Tax effect of income not taxable for

tax purpose (532)

Tax effect of expenses not

deductible for tax purpose 571

Tax effect of tax losses not

recognised 62

Utilisation of tax losses previously

not recognised (58)

Utilisation of deductible temporary differences previously

not recognised (321)

2021

千港元

HK$'000 (2,354)

(388) (319) 85 646 -

(24)

-

Income tax expense

At 31 December 2021, the Group has unused tax loss of approximately HK$14,812,000 (2020: HK$10,897,000) available for offset against future profits. No deferred tax asset has been recognised in respect of such tax losses due to the unpredictability of future profits streams. The tax losses do not expire under current tax legislation.

-

Financial Statements 財務報表 123