Page 155 - Kolte Patil AR 2019-20

P. 155

As at March 31, 2020

4,011

358

196

54

4,619

As at March 31, 2020

3,197

1,715

403

5,315

As at March 31, 2020

2,383

104

125

16

7

746

163

384

44

517

65

754

70

404

-

147

548

6,477

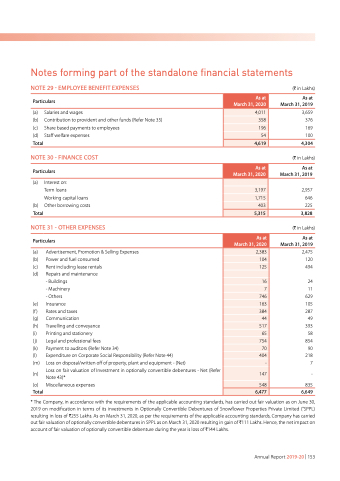

Notes forming part of the standalone financial statements

NOTE 29 - EMPLOYEE BENEFIT EXPENSES

Particulars

(a) Salaries and wages

(b) Contribution to provident and other funds (Refer Note 35)

(c) Share based payments to employees

(d) Staff welfare expenses

Total

NOTE 30 - FINANCE COST

Particulars

(H in Lakhs)

As at March 31, 2019 3,659 376 169 100 4,304

(H in Lakhs) As at

March 31, 2019

2,957 646 225 3,828

(H in Lakhs)

As at March 31, 2019 2,475

120

494

24

11

629

105

287

49

393

58

854

90

218

7

-

835

6,649

(a)

(b)

Total

Interest on:

Term loans

Working capital loans Other borrowing costs

NOTE 31 - OTHER EXPENSES

Particulars

(a) Advertisement, Promotion & Selling Expenses

(b) Power and fuel consumed

(c) Rent including lease rentals

(d) Repairs and maintenance

- Buildings - Machinery - Others

(e) Insurance

(f) Rates and taxes

(g) Communication

(h) Travelling and conveyance

(i) Printing and stationery

(j) Legal and professional fees

(k) Payment to auditors (Refer Note 34)

(l) Expenditure on Corporate Social Responsibility (Refer Note 44)

(m) Loss on disposal/written off of property, plant and equipment - (Net)

(n) Loss on fair valuation of Investment in optionally convertible debentures - Net (Refer

Note 43)*

(o) Miscellaneous expenses

Total

* The Company, in accordance with the requirements of the applicable accounting standards, has carried out fair valuation as on June 30, 2019 on modification in terms of its investments in Optionally Convertible Debentures of Snowflower Properties Private Limited (“SPPL) resulting in loss of H255 Lakhs. As on March 31, 2020, as per the requirements of the applicable accounting standards, Company has carried out fair valuation of optionally convertible debentures in SPPL as on March 31, 2020 resulting in gain of H111 Lakhs. Hence, the net impact on account of fair valuation of optionally convertible debenture during the year is loss of H144 Lakhs.

Annual Report 2019-20 | 153