Page 161 - Kolte Patil AR 2019-20

P. 161

As at March 31, 2020

6,420

10

758

762

8.47

8.43

As at March 31, 2020

39,602

2,077

37,525

86,307

43%

-

-

2,077

2,077

-

-

636

636

4,176

4,176

17,425

-

24,148

41,573

-

-

2,213

2,213

-

-

18,425

18,425

Notes forming part of the standalone financial statements

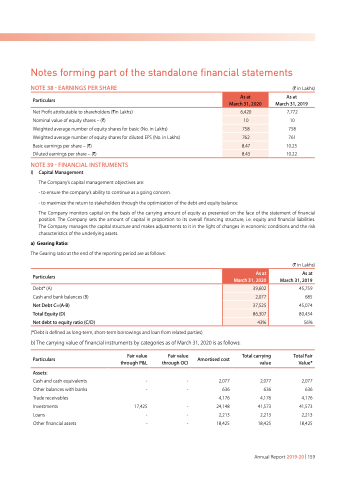

NOTE 38 - EARNINGS PER SHARE

Particulars

Net Profit attributable to shareholders (Hin Lakhs)

Nominal value of equity shares – (H)

Weighted average number of equity shares for basic (No. in Lakhs) Weighted average number of equity shares for diluted EPS (No. in Lakhs) Basic earnings per share – (H)

Diluted earnings per share – (H)

NOTE 39 - FINANCIAL INSTRUMENTS

I) Capital Management

The Company’s capital management objectives are:

- to ensure the company’s ability to continue as a going concern.

- to maximize the return to stakeholders through the optimization of the debt and equity balance.

(H in Lakhs) As at

March 31, 2019

7,772

10

758

761

10.25

10.22

The Company monitors capital on the basis of the carrying amount of equity as presented on the face of the statement of financial position. The Company sets the amount of capital in proportion to its overall financing structure, i.e. equity and financial liabilities. The Company manages the capital structure and makes adjustments to it in the light of changes in economic conditions and the risk characteristics of the underlying assets.

a) Gearing Ratio:

The Gearing ratio at the end of the reporting period are as follows:

Particulars

Debt* (A)

Cash and bank balances (B) Net Debt C=(A-B)

Total Equity (D)

Net debt to equity ratio (C/D)

(*Debt is defined as long-term, short-term borrowings and loan from related parties)

b) The carrying value of financial instruments by categories as of March 31, 2020 is as follows:

(H in Lakhs) As at

March 31, 2019

45,759 685 45,074 80,434 56%

Total Fair Value*

2,077 636 4,176 41,573 2,213 18,425

Particulars

Assets:

Cash and cash equivalents Other balances with banks Trade receivables Investments

Loans

Other financial assets

Fair value through P&L

Fair value through OCI

Amortised cost

Total carrying value

Annual Report 2019-20 | 159