Page 162 - Kolte Patil AR 2019-20

P. 162

Notes forming part of the standalone financial statements

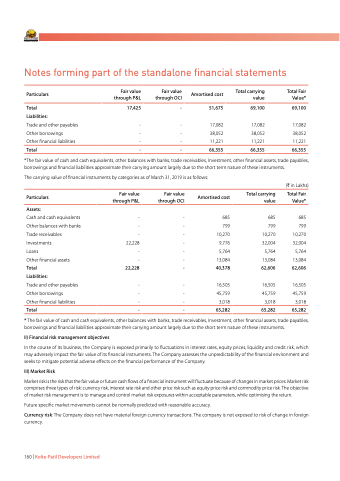

Particulars Fair value through P&L

Total 17,425 Liabilities:

Trade and other payables

Other borrowings

Other financial liabilities

Total -

Fair value through OCI

-

- - - -

Amortised cost 51,675

17,082 38,052 11,221 66,355

Total carrying value

69,100

17,082 38,052 11,221 66,355

Total Fair Value*

69,100

17,082 38,052 11,221 66,355

Particulars

Assets:

Fair value through P&L

Fair value through OCI

- - - - - - -

Amortised cost

685

799 10,270 9,776 5,764 13,084 40,378

16,505 45,759 3,018 65,282

Total carrying value

685

799 10,270 32,004 5,764 13,084 62,606

16,505 45,759 3,018 65,282

Cash and cash equivalents

Other balances with banks

Trade receivables

Investments 22,228 Loans - Other financial assets - Total 22,228 Liabilities:

Trade and other payables

Other borrowings

Other financial liabilities

Total -

- - -

- - -

*The fair value of cash and cash equivalents, other balances with banks, trade

borrowings and financial liabilities approximate their carrying amount largely due to the short term nature of these instruments.

receivables, Investment, other financial assets, trade payables, The carrying value of financial instruments by categories as of March 31, 2019 is as follows:

(H in Lakhs) Total Fair

Value*

685

799 10,270 32,004 5,764 13,084 62,606

16,505 45,759 3,018 65,282

In the course of its business, the Company is exposed primarily to fluctuations in interest rates, equity prices, liquidity and credit risk, which may adversely impact the fair value of its financial instruments. The Company assesses the unpredictability of the financial environment and seeks to mitigate potential adverse effects on the financial performance of the Company.

III) Market Risk

Market risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Market risk comprises three types of risk: currency risk, interest rate risk and other price risk such as equity price risk and commodity price risk. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimising the return.

Future specific market movements cannot be normally predicted with reasonable accuracy.

Currency risk: The Company does not have material foreign currency transactions. The company is not exposed to risk of change in foreign currency.

- - - - - -

-

* The fair value of cash and cash equivalents, other balances with banks, trade receivables, Investment, other financial assets, trade payables,

borrowings and financial liabilities approximate their carrying amount largely due to the short term nature of these instruments.

II) Financial risk management objectives

160 | Kolte-Patil Developers Limited