Page 164 - Kolte Patil AR 2019-20

P. 164

Notes forming part of the standalone financial statements

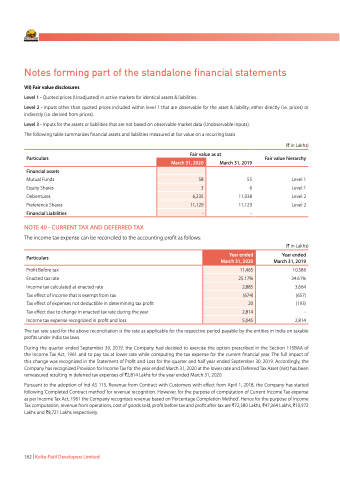

VII) Fair value disclosures

Level 1 - Quoted prices (Unadjusted) in active markets for identical assets & liabilities.

Level 2 - Inputs other than quoted prices included within level 1 that are observable for the asset & liability, either directly (i.e. prices) or

indirectly (i.e. derived from prices).

Level 3 - Inputs for the assets or liabilities that are not based on observable market data (Unobservable inputs). The following table summarizes financial assets and liabilities measured at fair value on a recurring basis

Particulars

Financial assets

Fair value as at

(H in Lakhs) Fair value hierarchy

Level 1 Level 1 Level 2 Level 2

(H in Lakhs) Year ended

March 31, 2019

10,586 34.61% 3,664 (657) (193) - 2,814

Mutual Funds

Equity Shares

Debentures 6,235 Preference Shares 11,129

Financial Liabilities

NOTE 40 - CURRENT TAX AND DEFERRED TAX

The income tax expense can be reconciled to the accounting profit as follows:

Particulars

Profit Before tax

Enacted tax rate

Income tax calculated at enacted rate

Tax effect of income that is exempt from tax

Tax effect of expenses not deductible in determining tax profit Tax effect due to change in enacted tax rate during the year Income tax expense recognized in profit and loss

-

The tax rate used for the above reconciliation is the rate as applicable for the respective period payable by the entities in India on taxable profits under India tax laws.

During the quarter ended September 30, 2019, the Company had decided to exercise the option prescribed in the Section 115BAA of the Income Tax Act, 1961 and to pay tax at lower rate while computing the tax expense for the current financial year. The full impact of this change was recognized in the Statement of Profit and Loss for the quarter and half year ended September 30, 2019. Accordingly, the Company has recognized Provision for lncome Tax for the year ended March 31, 2020 at the lower rate and Deferred Tax Asset (net) has been remeasured resulting in deferred tax expenses of H2,814 Lakhs for the year ended March 31, 2020.

Pursuant to the adoption of Ind AS 115, Revenue from Contract with Customers with effect from April 1, 2018, the Company has started following ‘Completed Contract method’ for revenue recognition. However, for the purpose of computation of Current Income Tax expense as per Income Tax Act, 1961 the Company recognizes revenue based on ‘Percentage Completion Method’. Hence for the purpose of Income Tax computation, revenue from operations, cost of goods sold, profit before tax and profit after tax are H72,580 Lakhs, H47,364 Lakhs, H10,972 Lakhs and H8,721 Lakhs respectively.

162 | Kolte-Patil Developers Limited

March 31, 2020

March 31, 2019

55 6 11,038 11,129 -

Year ended March 31, 2020

11,465 25.17% 2,885 (674) 20 2,814 5,045

58 3