Page 9 - ie2 August 2019

P. 9

THE INDIAN MEDICAL DEVICES INDUSTRY

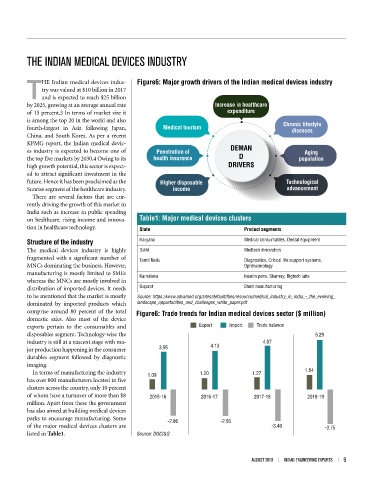

HE Indian medical devices indus- Figure6: Major growth drivers of the Indian medical devices industry

try was valued at $10 billion in 2017

Tand is expected to reach $25 billion

by 2025, growing at an average annual rate Increase in healthcare

of 15 percent.3 In terms of market size it expenditure

is among the top 20 in the world and also Chronic lifestyle

fourth-largest in Asia following Japan, Medical tourism diseases

China, and South Korea. As per a recent

KPMG report, the Indian medical devic-

es industry is expected to become one of Penetration of DEMAN Aging

the top five markets by 2030.4 Owing to its health insurance D population

high growth potential, this sector is expect- DRIVERS

ed to attract significant investment in the

future. Hence it has been proclaimed as the Higher disposable Technological

Sunrise segment of the healthcare industry. income advancement

There are several factors that are cur-

rently driving the growth of this market in

India such as increase in public spending

on healthcare, rising income and innova- Table1: Major medical devices clusters

tion in healthcare technology. State Product segments

Structure of the industry Haryana Medical consumables, Dental equipment

The medical devices industry is highly Delhi Medtech innovators

fragmented with a significant number of Tamil Nadu Diagnostics, Critical life support systems,

MNCs dominating the business. However, Ophthalmology

manufacturing is mostly limited to SMEs Karnataka Insulin pens, Skanray, Bigtech labs

whereas the MNCs are mostly involved in

distribution of imported devices. It needs Gujarat Stent manufacturing

to be mentioned that the market is mostly Source: https://www.advamed.org/sites/default/files/resource/medical_industry_in_india_-_the_evolving_

dominated by imported products which landscape_oppurtunities_and_challenges_white_paper.pdf

comprise around 80 percent of the total Figure6: Trade trends for Indian medical devices sector ($ million)

domestic sales. Also most of the device

exports pertain to the consumables and Export Import Trade balance

disposables segment. Technology-wise the 5.29

industry is still at a nascent stage with ma- 4.13 4.67

jor production happening in the consumer 3.95

durables segment followed by diagnostic

imaging.

In terms of manufacturing the industry 1.09 1.20 1.27 1.54

has over 800 manufacturers located in five

clusters across the country, only 10 percent

of whom have a turnover of more than $8 2015-16 2016-17 2017-18 2018-19

million. Apart from these the government

has also aimed at building medical devices

parks to encourage manufacturing. Some -2.86 -2.93

of the major medical devices clusters are -3.40 -3.75

listed in Table1. Source: DGCI&S

AUGUST 2019 l INDIAN ENGINEERING EXPORTS l 9