Page 9 - Publishers_Weekly

P. 9

News

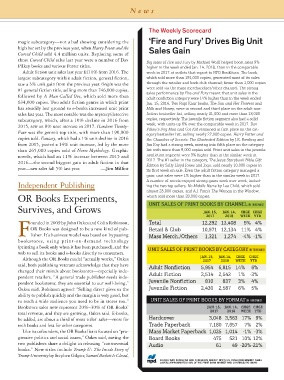

The Weekly Scorecard

magic subcategory—not a bad showing considering the ‘Fire and Fury’ Drives Big Unit

high bar set by the previous year, when Harry Potter and the Sales Gain

Cursed Child sold 4.4 million units. Replacing some of

those Cursed Child sales last year were a number of Dav

Big sales of Fire and Fury by Mich ael Wolff helped boost sales 9%

Pilkey books and various Potter titles. higher in the week ended Jan. 14, 2018, than in the comparable

Adult fiction unit sales last year fell 1% from 2016. The week in 2017 at outlets that report to NPD BookScan. The book,

largest subcategory within adult fiction, general fiction, which sold more than 191,000 copies, generated most of its sales

saw a 3% unit gain from the previous year. Origin was the through the retailer and book club ch annel; fewer than 1,000 copies

were sold via the mass merch andiser/other ch annel. The strong

#1 general fiction title, selling more than 746,000 copies,

sales performance by Fire and Fury meant that unit sales in the

followed by A Man Called Ove, which sold more than

adult nonfi ction category were 14% higher than in the week ended

634,000 copies. Two adult fiction genres in which print Jan. 15, 2016. Two Rupi Kaur books, The Sun and Her Flowers and

has steadily lost ground to e-books increased unit print Milk and Honey, were in second and third place on the adult non-

sales last year. The most notable was the mystery/detective fi ction bestseller list, selling nearly 21,000 and more than 18,000

subcategory, which, after a 10% decline in 2016 from copies, respectively. The juvenile fi ction segment also had a solid

week, with units up 6% over the comparable week in 2017. Dav

2015, saw an 8% unit increase in 2017. Hardcore Twenty-

Pilkey’s Dog Man and Cat Kid remained in fi rst place on the cat-

Four was the genre’s top title, with more than 190,000

egory bestseller list, selling nearly 27,000 copies. Harry Potter and

copies sold. Fantasy, which had a 1% unit decline in 2016 the Chamber of Secrets: The Illustrated Edition by J.K. Rowling and

from 2015, posted a 14% unit increase, led by the more Jim Kay had a strong week, moving into fi fth place on the category

than 265,000 copies sold of Norse Mythology. Graphic list with more than 9,000 copies sold. Print unit sales in the juvenile

novels, which had an 11% increase between 2015 and nonfi ction segment were 3% higher than in the similar week in

2017. The #1 seller in the category, The Jesus Storybook Bible Gift

2016—the second biggest gain in adult fiction in that

Edition by Sally Lloyd-Jones and Jago, sold nearly 10,000 copies in

year—saw sales fall 5% last year. —Jim Milliot

its fi rst week on sale. Even the adult fi ction category managed a

gain: unit sales were 1% higher than in the similar week in 2017.

A number of novels enjoyed strong gains week over week, includ-

Independent Publishing ing the two top sellers, No Middle Name by Lee Child, which sold

almost 25,000 copies, and A.J. Finn’s The Woman in the Window,

OR Books Experiments, which sold more than 20,000 copies.

UNIT SALES OF PRINT BOOKS BY CHANNEL (in thousands)

Survives, and Grows JAN. 15, JAN. 14, CHGE CHGE

2017 2018 WEEK YTD

ounded in 2009 by John Oakes and Colin Robinson, Total 12,292 13,408 9% 4%

OR Books was designed to be a new kind of pub- Retail & Club 10,971 12,134 11% 4%

Flisher. It’s business model was based on bypassing Mass Merch ./Others 1,321 1,274 -4% -1%

bookstores, using print-on-demand technology

(printing a book only when it has been purchased), and the

UNIT SALES OF PRINT BOOKS BY CATEGORY (in thousands)

web to sell its books and e-books directly to consumers.

JAN. 15, JAN.14, CHGE CHGE

Although the OR Books model “actually works,” Oakes

2017 2018 WEEK YTD

said, both publishing veterans acknowledge that they have

Adult Nonfi ction 5,954 6,815 14% 6%

changed their minds about bookstores—especially inde-

Adult Fiction 2,514 2,542 1% -3%

pendent retailers. “A general trade publisher needs inde-

Juvenile Nonfi ction 810 837 3% 4%

pendent bookstores; they are essential to our well-being,”

Oakes said. Robinson agreed: “Selling direct gives us the Juvenile Fiction 2,430 2,587 6% 5%

ability to publish quickly and the margin is very good, but

to reach a wide audience you need to be in stores too.” UNIT SALES OF PRINT BOOKS BY FORMAT (in thousands)

Bookstore sales now represent 20%–30% of OR Books’ JAN. 15, JAN. 14, CHGE CHGE

2017 2018 WEEK YTD

total revenue, and they are growing, Oakes said. E-books,

he added, are about a third of most titles’ sales—more for Hardcover 3,048 3,563 17% 9%

tech books and less for other categories. Trade Paperback 7,180 7,657 7% 2%

Like its cofounders, the OR Books list is focused on “pro- Mass Market Paperback 1,025 1,014 -1% -3%

gressive politics and social issues,” Oakes said, noting the Board Books 475 521 10% 12%

two publishers share a delight in releasing “controversial Audio 61 49 -20%-21%

books.” New titles include Trump U: The Inside Story of

Trump University by Stephen Gilpin; Samuel Beckett Is Closed,

SOURCE: NPD BOOKSCAN AND PUBLISHERS WEEKLY. NPD’S U.S. CONSUMER MARKET PANEL

COVERS APPROXIMATELY 80% OF THE PRINT BOOK MARKET AND CONTINUES TO GROW.