Page 21 - VIRANSH COACHING CLASSES

P. 21

3) Distribution of profit

3

Mr. Amey = 5 × 90,000 = ` 54,000

2

Mr. Ashish = 5 × 90,000 = ` 36,000

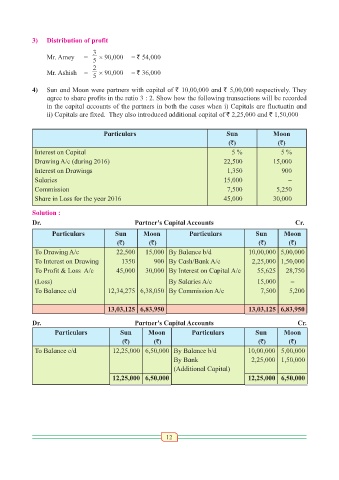

4) Sun and Moon were partners with capital of ` 10,00,000 and ` 5,00,000 respectively. They

agree to share profits in the ratio 3 : 2. Show how the following transactions will be recorded

in the capital accounts of the partners in both the cases when i) Capitals are fluctuatin and

ii) Capitals are fixed. They also introduced additional capital of ` 2,25,000 and ` 1,50,000

Particulars Sun Moon

(`) (`)

Interest on Capital 5 % 5 %

Drawing A/c (during 2016) 22,500 15,000

Interest on Drawings 1,350 900

Salaries 15,000 -

Commission 7,500 5,250

Share in Loss for the year 2016 45,000 30,000

Solution :

Dr. Partner's Capital Accounts Cr.

Particulars Sun Moon Particulars Sun Moon

(`) (`) (`) (`)

To Drawing A/c 22,500 15,000 By Balance b/d 10,00,000 5,00,000

To Interest on Drawing 1350 900 By Cash/Bank A/c 2,25,000 1,50,000

To Profit & Loss A/c 45,000 30,000 By Interest on Capital A/c 55,625 28,750

(Loss) By Salaries A/c 15,000 -

To Balance c/d 12,34,275 6,38,050 By Commission A/c 7,500 5,200

13,03,125 6,83,950 13,03,125 6,83,950

Dr. Partner's Capital Accounts Cr.

Particulars Sun Moon Particulars Sun Moon

(`) (`) (`) (`)

To Balance c/d 12,25,000 6,50,000 By Balance b/d 10,00,000 5,00,000

By Bank 2,25,000 1,50,000

(Additional Capital)

12,25,000 6,50,000 12,25,000 6,50,000

12