Page 5 - Canada Dry Bottling Renewal 2020

P. 5

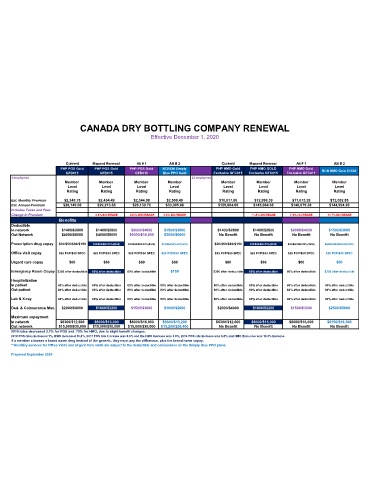

CANADA DRY BOTTLING COMPANY RENEWAL

Effective December 1, 2020

Current Mapped Renewal Alt # 1 Alt # 2 Current Mapped Renewal Alt # 1 Alt # 2

PHP POS Gold PHP POS Gold PHP POS Gold BCBSM Simply PHP HMO Gold PHP HMO GOLD PHP HMO Gold

GFD015 GFD015 GFD018 Blue PPO Gold Exclusive GFC015 Exclusive GFC015 Exclusive GFC011 BCN HMO Gold $1500

3 employees 22 employees

Member Member Member Member Member Member Member Member

Level Level Level Level Level Level Level Level

Rating Rating Rating Rating Rating Rating Rating Rating

Est. Monthly Premium $2,345.75 $2,434.49 $2,344.98 $2,500.49 $10,817.00 $12,090.39 $11,673.28 $12,082.85

Est. Annual Premium $28,149.00 $29,213.88 $28,139.76 $30,005.88 $129,804.00 $145,084.68 $140,079.36 $144,994.20

Includes Taxes and Fees

Change in Premium 3.8% INCREASE .033% DECREASE 6.6% INCREASE 11.8% INCREASE 7.9% INCREASE 11.7% INCREASE

Benefits

Deductible

In network $1400/$2800 $1400/$2800 $2000/$4000 $1500/$3000 $1400/$2800 $1400/$2800 $2000/$4000 $1500/$3000

Out Network $4000/$8000 $4000/$8000 $5000/$10,000 $3000/$6000 No Benefit No Benefit No Benefit No Benefit

Prescription drug copay $20/$50/$80/$150 $20/$50/$80/20%($300) $20/$50/$80/20%($300) $15/$50/50%/20%/25% $20/$50/$80/$150 $20/$50/$80/20%($300) $20/$50/$80/20%($300) $6/$25/$50/$80/20%/20%

Office visit copay $25 PCP/$50 SPEC $25 PCP/$50 SPEC $25 PCP/$50 SPEC $20 PCP/$40 SPEC $25 PCP/$50 SPEC $25 PCP/$50 SPEC $25 PCP/$50 SPEC $20 PCP/$40 SPEC

Urgent care copay $60 $60 $60 $60 $60 $60 $60 $50

Emergency Room Copay $300 after deductible 80% after deductible 80% after deductible $150 $300 after deductible 80% after deductible 80% after deductible $250 after deductible

Hospitalization

In patient 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible

Out patient 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible

Lab & X-ray 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible 80% after deductible

Ded. & Coinsurance Max. $2000/$4000 $1600/$3200 $1500/$3000 $1000/$2000 $2000/$4000 $1600/$3200 $1500/$3000 $2500/$5000

Maximum copayment

In network $6300/$12,600 $8000/$16,000 $8000/$16,000 $6600/$13,200 $6300/$12,600 $8000/$16,000 $8000/$16,000 $8150/$16,300

Out network $15,000/$30,000 $15,000/$30,000 $15,000/$30,000 $13,200/$26,400 No Benefit No Benefit No Benefit No Benefit

2019 rates decreased 2.7% for POS and .75% for HMO, due to slight benefit changes.

2018 POS rates increased 1%, HMO increased 10.6%, 2017 POS rate increase was 8.6% and the HMO increase was 3.8%, 2016 POS rate increase was 8.8% and HMO Exclusive was 10.3% increase

If a member chooses a brand name drug instead of the generic, they must pay the difference, plus the brand name copay.

**Ancillary services for Office Visits and Urgent Care visits are subject to the deductible and coinsurance on the Simply Blue PPO plans.

Prepared September 2020