Page 8 - Real_Estate_Book_Karen_Carey

P. 8

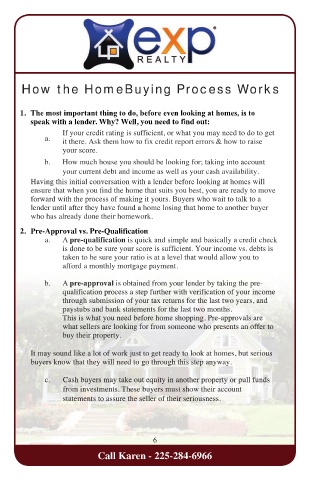

How the HomeBuying Process Works

1. The most important thing to do, before even looking at homes, is to

speak with a lender. Why? Well, you need to find out:find out:f

If your credit rating is sufficient, or what you may need to do to get

a.

it there. Ask them how to fix credit report errors & how to raise

your score.

b. How much house you should be looking for; taking into account

your current debt and income as well as your cash availability.

Having this initial conversation with a lender before looking at homes will

ensure that when you find the home that suits you best, you are ready to move

forward with the process of making it yours. Buyers who wait to talk to a

lender until after they have found a home losing that home to another buyer

who has already done their homework.

2. Pre-Approval vs. Pre-Qualificationficationf

a. A pre-qualipre-qualipr fication is quick and simple and basically a credit check

is done to be sure your score is sufficient. Your income vs. debts is

taken to be sure your ratio is at a level that would allow you to

afford a monthly mortgage payment.

b. A pre-approval is obtained from your lender by taking the pre-

qualification process a step further with verification of your income income

qualification process a step further with verification of your

qualification process a step further with verification of your

through submission of your tax returns for the last two years, and

paystubs and bank statements for the last two months.

This is what you need before home shopping. Pre-approvals are

what sellers are looking for from someone who presents an offer

what sellers are looking for from someone who presents an offer

what sellers are looking for from someone who presents an offer to to

buy their property.

It may sound like a lot of work just to get ready to look at

It may sound like a lot of work just to get ready to look at homes, but serious homes, but serious

It may sound like a lot of work just to get ready to look at

buyers know that they will need to go through this step anyway.

Cash buyers may take out equity in another property or pull f

Cash buyers may take out equity in another property or pull f

c. Cash buyers may take out equity in another property or pull funds unds

from investments. These buyers must show their account

statements to assure the seller of their seriousness.

6 6

Call Karen - 225-284-6966