Page 18 - Reeftankers - Annexure B Sasfin

P. 18

SASFIN BCI STABLE FUND (B)

MANAGED BY: SASFIN ASSET MANAGERS (PTY) LTD - AUTHORISED FSP 21664

MINIMUM DISCLOSURE DOCUMENT

31 MARCH 2018

INVESTMENT OBJECTIVE FUND INFORMATION

The Sasfin BCI Stable Fund is a cautious managed portfolio with the investment objective Portfolio Manager: Errol Shear

to achieve above real inflation beating total returns by way of delivering relatively high Launch date: 01 Mar 2013

income with a measure of capital growth over the medium to long term. Portfolio Value: R 227 506 680

NAV Price (Fund Inception): 100 cents

INVESTMENT UNIVERSE NAV Price as at month end: 115.76 cents

JSE Code: SMSFCB

In order to achieve this objective the investments to be acquired for the portfolio will

include listed property related securities, equity securities, preference shares, non- ISIN Number: ZAE000175733

equity securities, fixed interest instruments (including, but not limited to, bonds, ASISA Category: SA Multi Asset Low Equity

corporate bonds, inflation linked bonds, convertible bonds, cash deposits and money Benchmark: Average of SA Multi Asset Low

market instruments) and assets in liquid form. To provide a level of capital protection, Equity Category

the portfolio’s equity exposure shall be limited to 40% of the portfolio’s net asset value. Minimum lump sum: R 25 000

The portfolio may from time to time invest in listed and unlisted financial instruments. Minimum monthly Investment: R 1 000

The manager may also include unlisted forward currency, interest rate and exchange

rate swap transactions for efficient portfolio management purposes. This fund complies Valuation: Daily

with Regulation 28. Valuation time: 15:00

Transaction time: 14:00

Date of Income Declaration: 28 Feb/31 May/31 Aug/30 Nov

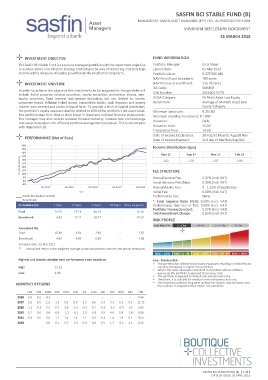

PERFORMANCE (Net of Fees)

Date of Income Payment: 2nd day of Mar/Jun/Sep/Dec

50% Income Distribution (cpu)

45%

40% May-17 Aug-17 Nov-17 Feb-18

% Cumulative Return 30% 2.02 1.93 2.07 1.80

35%

25%

20%

15%

10%

Annual Service Fee:

5% FEE STRUCTURE 0.37% (Incl. VAT)

0%

-5% Initial Advisory Fee (Max): 0.00% (Incl. VAT)

03-2014 03-2015 03-2016 03-2017 03-2018 Annual Advice Fee: 0 - 1.15% (if applicable)

Date Initial Fee: 0.00% (Incl. VAT)

Sasfin BCI Stable Fund (B) Performance Fee: None

Benchmark * Total Expense Ratio (TER): 0.58% (Incl. VAT)

Cumulative (%) 1 Year 3 Years 5 Years 10 Years Since Inception Performance fees incl in TER: 0.00% (Incl. VAT)

Fund 10.26 22.19 46.23 - 47.05 Portfolio Transaction Cost: 0.07% (Incl. VAT)

Total Investment Charge:

0.65% (Incl. VAT)

Benchmark 4.83 15.27 39.57 - 41.62

RISK PROFILE

Annualised (%)

Fund 10.26 6.91 7.90 - 7.87

Benchmark 4.83 4.85 6.89 - 7.08

Inception date: 01 Mar 2013

** Annualised return is the weighted average compound growth rate over the period measured.

Highest and lowest calendar year performance since inception Low - Medium Risk

• This portfolio has relatively low equity exposure, resulting in relatively low

High 13.15 volatility compared to higher risk portfolios.

• Where the asset allocation contained in this MDD reflects offshore

Low 2.83 exposure, the portfolio is exposed to currency risks

• The portfolio is exposed to default and interest rate risks.

• Therefore, it is suitable for medium term investment horizons.

• The expected potential long term investment returns may be lower over

MONTHLY RETURNS

the medium to long term than higher risk portfolios.

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC YTD

2018 0.4 0.2 -0.1 - - - - - - - - - 0.46

2017 1.0 0.2 1.9 1.2 0.9 0.0 2.5 0.6 1.4 2.2 0.2 0.5 13.15

2016 -1.1 -0.2 2.9 0.7 2.6 -1.0 -0.1 0.7 -0.5 -1.6 -0.4 1.0 2.83

2015 3.7 0.0 0.8 0.9 -1.1 -0.1 2.3 -0.5 0.2 4.0 0.8 -1.8 9.26

2014 -0.3 0.6 0.9 1.1 1.4 1.4 1.1 0.9 -0.4 1.4 1.9 0.1 10.57

2013 - - 0.6 0.1 0.7 -3.2 0.9 -0.3 2.5 1.7 -0.1 1.3 4.13

SASFIN BCI STABLE FUND (B) | 1 of 2

DATE OF ISSUE: 20 APRIL 2018