Page 14 - Reeftankers - Annexure B Sasfin

P. 14

SASFIN BCI PRUDENTIAL FUND (B)

MANAGED BY: SASFIN ASSET MANAGERS (PTY) LTD - AUTHORISED FSP 21664

MINIMUM DISCLOSURE DOCUMENT

31 MARCH 2018

INVESTMENT OBJECTIVE FUND INFORMATION

The Sasfin BCI Prudential Fund is a managed portfolio seeking to deliver long term capital Portfolio Manager: Philip Bradford

growth and income normally associated with the investment structure of a moderate Launch date: 02 Jan 2013

risk profile retirement fund. Portfolio Value: R 1 659 073 400

NAV Price (Fund Inception): 142.77 cents

INVESTMENT UNIVERSE NAV Price as at month end: 178.37 cents

JSE Code: SAMCB

In order to benefit from positive market conditions and to provide a limited measure of

capital and income protection during negative market conditions, the Manager will ISIN Number: ZAE000174785

manage the portfolio’s equity, property and fixed interest asset allocation actively to ASISA Category: SA Multi Asset High Equity

align the portfolio with the Manager’s outlook of such conditions. In order to achieve Benchmark: Average of SA Multi Asset High

this objective the investments to be acquired for the portfolio will include listed property Equity Category

related securities, equity securities, preference shares, non-equity securities, fixed Minimum lump sum: R 25 000

interest instruments (including, but not limited to, bonds, corporate bonds, inflation Minimum monthly Investment: R 1 000

linked bonds, convertible bonds, cash deposits and money market instruments) and

assets in liquid form. The portfolio may from time to time invest in listed and unlisted Valuation: Daily

financial instruments. The manager may also include unlisted forward currency, interest Valuation time: 15:00

rate and exchange rate swap transactions for efficient portfolio management purposes. Transaction time: 14:00

This fund complies with Regulation 28. Date of Income Declaration: 28 February/31 August

Date of Income Payment: 2nd working day of Mar/Sep

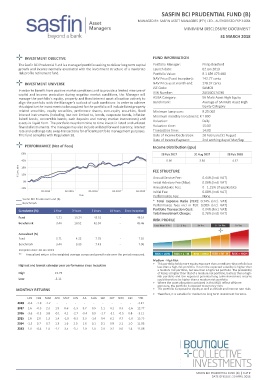

PERFORMANCE (Net of Fees) Income Distribution (cpu)

60% 28 Feb 2017 31 Aug 2017 28 Feb 2018

45% 0.90 3.84 4.37

% Cumulative 30% FEE STRUCTURE

15%

Annual Service Fee: 0.44% (Incl. VAT)

0% Initial Advisory Fee (Max): 0.00% (Incl. VAT)

-15% Annual Advice Fee: 0 - 1.15% (if applicable)

03-2014 03-2015 03-2016 03-2017 03-2018 Initial Fee: 0.00% (Incl. VAT)

Date Performance Fee: None

Sasfin BCI Prudential Fund (B)

Benchmark * Total Expense Ratio (TER): 0.74% (Incl. VAT)

Performance fees incl in TER: 0.00% (Incl. VAT)

Portfolio Transaction Cost: 0.04% (Incl. VAT)

Cumulative (%) 1 Year 3 Years 5 Years 10 Years Since Inception

Total Investment Charge: 0.78% (Incl. VAT)

Fund 5.71 13.24 45.51 - 49.14

Benchmark 3.44 10.52 42.94 - 49.46 RISK PROFILE

Annualised (%)

Fund 5.71 4.23 7.79 - 7.92

Benchmark 3.44 3.39 7.41 - 7.96

Inception date: 02 Jan 2013

** Annualised return is the weighted average compound growth rate over the period measured.

Medium - High Risk

• This portfolio holds more equity exposure than a medium risk portfolio but

Highest and lowest calendar year performance since inception

less than a high-risk portfolio. In turn the expected volatility is higher than

a medium risk portfolio, but less than a high-risk portfolio. The probability

High 13.73 of losses is higher than that of a medium risk portfolio, but less than a high-

risk portfolio and the expected potential long term investment returns

Low -3.11 could therefore be higher than a medium risk portfolio.

• Where the asset allocation contained in this MDD reflect offshore

exposure, the portfolio is exposed to currency risks

MONTHLY RETURNS • The portfolio is exposed to equity as well as default and interest rate risks.

• Therefore, it is suitable for medium to long term investment horizons.

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC YTD

2018 -0.4 -1.9 -1.2 - - - - - - - - - -3.41

2017 1.6 -0.9 2.3 1.9 0.6 -1.3 3.7 0.5 1.1 4.1 0.3 -1.6 12.77

2016 -3.6 -0.5 3.8 -0.1 4.2 -2.7 -0.4 0.9 -1.7 -3.1 -0.5 0.8 -3.11

2015 2.6 2.0 1.3 1.4 -1.8 -0.3 3.3 -1.6 0.4 6.1 0.7 -1.0 13.73

2014 -1.5 0.7 0.7 1.3 1.6 2.0 1.6 0.1 0.1 0.9 2.1 1.0 11.05

2013 1.0 -0.4 1.9 -1.1 3.5 -3.7 1.9 1.0 2.9 3.1 0.0 1.4 11.88

SASFIN BCI PRUDENTIAL FUND (B) | 1 of 2

DATE OF ISSUE: 20 APRIL 2018