Page 113 - Policy Wording - Hollard Business Binder (2020-08-26)

P. 113

4.

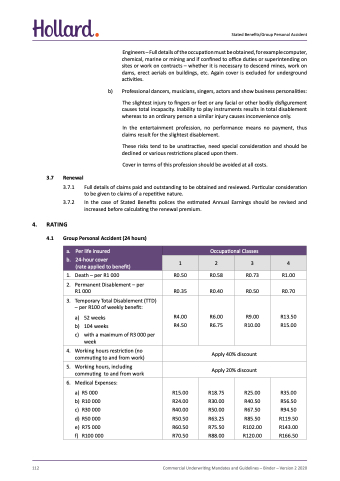

RATING

3.7 Renewal

4.1

Group Personal Accident (24 hours)

3.7.1 Full details of claims paid and outstanding to be obtained and reviewed. Particular consideration to be given to claims of a repetitive nature.

3.7.2 In the case of Stated Benefits polices the estimated Annual Earnings should be revised and increased before calculating the renewal premium.

Stated Benefits/Group Personal Accident

Engineers – Full details of the occupation must be obtained, for example computer, chemical, marine or mining and if confined to office duties or superintending on sites or work on contracts – whether it is necessary to descend mines, work on dams, erect aerials on buildings, etc. Again cover is excluded for underground activities.

b) Professional dancers, musicians, singers, actors and show business personalities:

The slightest injury to fingers or feet or any facial or other bodily disfigurement causes total incapacity. Inability to play instruments results in total disablement whereas to an ordinary person a similar injury causes inconvenience only.

In the entertainment profession, no performance means no payment, thus claims result for the slightest disablement.

These risks tend to be unattractive, need special consideration and should be declined or various restrictions placed upon them.

Cover in terms of this profession should be avoided at all costs.

a. Per life insured

b. 24-hour cover

(rate applied to benefit)

Occupational Classes

1

2

3

4

1.

2.

4.

5.

Death – per R1 000

Permanent Disablement – per R1 000

Working hours restriction (no commuting to and from work)

Working hours, including commuting to and from work

R0.50 R0.58 R0.73

R0.35 R0.40 R0.50

Apply 40% discount

Apply 20% discount

R1.00

R0.70

3. Temporary Total Disablement (TTD) – per R100 of weekly benefit:

a) 52 weeks

b) 104 weeks

c) with a maximum of R3 000 per week

R4.00 R4.50

R6.00 R6.75

R9.00 R10.00

R13.50 R15.00

6. Medical Expenses:

a) R5 000

b) R10 000

c) R30 000

d) R50 000

e) R75 000

f) R100 000

R15.00 R24.00 R40.00 R50.50 R60.50 R70.50

R18.75 R30.00 R50.00 R63.25 R75.50 R88.00

R25.00 R40.50 R67.50 R85.50 R102.00 R120.00

R35.00 R56.50 R94.50 R119.50 R143.00 R166.50

112

Commercial Underwriting Mandates and Guidelines – Binder – Version 2 2020