Page 22 - refi book proof 2

P. 22

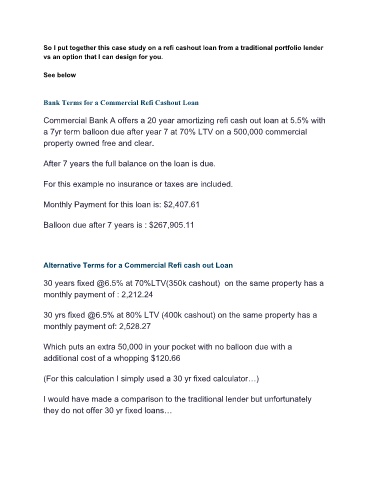

So I put together this case study on a refi cashout loan from a traditional portfolio lender

vs an option that I can design for you.

See below

Bank Terms for a Commercial Refi Cashout Loan

Commercial Bank A offers a 20 year amortizing refi cash out loan at 5.5% with

a 7yr term balloon due after year 7 at 70% LTV on a 500,000 commercial

property owned free and clear.

After 7 years the full balance on the loan is due.

For this example no insurance or taxes are included.

Monthly Payment for this loan is: $2,407.61

Balloon due after 7 years is : $267,905.11

Alternative Terms for a Commercial Refi cash out Loan

30 years fixed @6.5% at 70%LTV(350k cashout) on the same property has a

monthly payment of : 2,212.24

30 yrs fixed @6.5% at 80% LTV (400k cashout) on the same property has a

monthly payment of: 2,528.27

Which puts an extra 50,000 in your pocket with no balloon due with a

additional cost of a whopping $120.66

(For this calculation I simply used a 30 yr fixed calculator…)

I would have made a comparison to the traditional lender but unfortunately

they do not offer 30 yr fixed loans…