Page 9 - UIG Business Model Presentation

P. 9

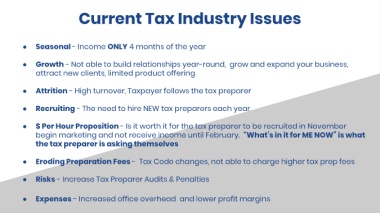

Current Tax Industry Issues

● Seasonal - Income ONLY 4 months of the year

● Growth - Not able to build relationships year-round, grow and expand your business,

attract new clients, limited product offering

● Attrition - High turnover, Taxpayer follows the tax preparer

● Recruiting - The need to hire NEW tax preparers each year

● $ Per Hour Proposition - Is it worth it for the tax preparer to be recruited in November

begin marketing and not receive income until February. “What’s in it for ME NOW” is what

the tax preparer is asking themselves

● Eroding Preparation Fees - Tax Code changes, not able to charge higher tax prep fees

● Risks - Increase Tax Preparer Audits & Penalties

● Expenses - Increased office overhead and lower profit margins