Page 8 - VTax Training Guide

P. 8

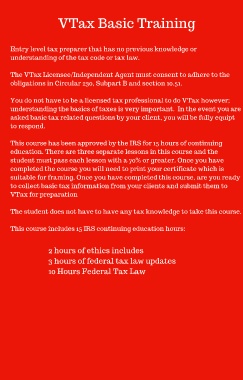

VTax Basic Training

Entry level tax preparer that has no previous knowledge or

understanding of the tax code or tax law.

The VTax Licensee/Independent Agent must consent to adhere to the

obligations in Circular 230, Subpart B and section 10.51.

You do not have to be a licensed tax professional to do VTax however;

understanding the basics of taxes is very important. In the event you are

asked basic tax related questions by your client, you will be fully equipt

to respond.

This course has been approved by the IRS for 15 hours of continuing

education. There are three separate lessons in this course and the

student must pass each lesson with a 70% or greater. Once you have

completed the course you will need to print your certificate which is

suitable for framing. Once you have completed this course, are you ready

to collect basic tax information from your clients and submit them to

VTax for preparation

The student does not have to have any tax knowledge to take this course.

This course includes 15 IRS continuing education hours:

2 hours of ethics includes

3 hours of federal tax law updates

10 Hours Federal Tax Law