Page 125 - Laporan Tahunan Universiti Malaya 2023

P. 125

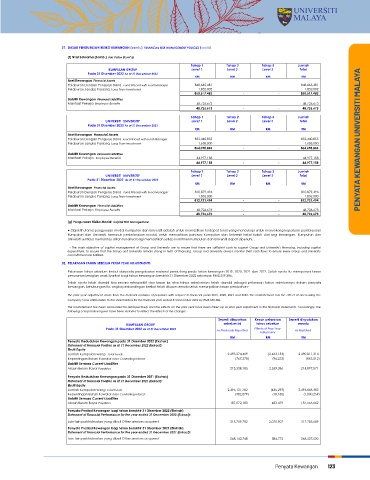

27. DASAR PENGURUSAN RISIKO KEWANGAN (samb.) FINANCIAL RISK MANAGEMENT POLICIES ( cont'd)

27. DASAR PENGURUSAN RISIKO KEWANGAN (samb) FINANCIAL RISK MANAGEMENT POLICIES (Cont'd)

(f) Nilai Saksama (Samb.) Fair Value (Cont'd)

Dalam Tempoh Diantara 1 Hingga 2 Diantara 3 Hingga 5

UNIVERSITI UNIVERSITY Melebihi 5 Tahun Jumlah

Setahun Tahun Tahun Tahap 1 Tahap 2 Tahap 3 Jumlah

Within a Year Between 1 to 2 Years Between 3 to 5 Years More than 5 Years Total KUMPULAN GROUP Level 1 Level 2 Level 3 Total

Pada 31 Disember 2022 As at 31 December 2022 RM RM RM RM RM Pada 31 Disember 2022 As at 31 December 2022

Akaun Belum Bayar Payables 162,301,948 - - - 162,301,948 Aset Kewangan Financial Assets RM RM RM RM

Tanggungan Lain Other Payables 8,168,376 - - - 8,168,376 Pelaburan Dengan Pengurus Dana Fund Placed with Fund Manager 848,665,481 848,665,481

Dana Penyelidikan MyLab MyLab Research Funds 61,183,830 - - - 61,183,830 Pelaburan Jangka Panjang Long Term Investment 1,852,002 1,852,002

Pemiutang - Penaja Biasiswa Payables - Scholarship Sponsors 12,975,159 - - - 12,975,159 850,517,483 - - 850,517,483

Tabung Biasiswa dan Hadiah Gift and Scholarship Funds 1,189,719 - - - 1,189,719 Liabiliti Kewangan Financial Liabilities

Tabung Derma Donation Funds 118,075,799 - - - 118,075,799 Manfaat Pekerja Employee Benefits 48,726,673 48,726,673

Manfaat Pekerja Employee Benefits 3,502,768 2,827,702 5,546,400 36,849,803 48,726,673 48,726,673 - - 48,726,673

367,397,599 2,827,702 5,546,400 36,849,803 412,621,504

Tahap 1 Tahap 2 Tahap 3 Jumlah

(c) Risiko Kadar Faedah Interest Rate Risk UNIVERSITI UNIVERSITY Level 1 Level 2 Level 3 Total

● Kumpulan terdedah kepada Risiko Kadar Faedah daripada aset dan liabiliti kewangan yang mempunyai kadar faedah. Risiko ini diuruskan mengikut objektif modal dan dasar Pada 31 Disember 2023 As at 31 December 2023 RM RM RM RM

pengurusan risiko. Objektif dan dasar ini termasuk mengekalkan gabungan yang sesuai antara pinjaman kadar tetap dan kadar terapung. Kadar faedah purata wajaran pada instrumen Aset Kewangan Financial Assets

kewangan adalah seperti berikut:

Pelaburan Dengan Pengurus Dana Fund Placed with Fund Manager 852,440,855 852,440,855 PENYATA KEWANGAN UNIVERSITI MALAYA

~ Group exposed to interest rate risk of financial assets and libilities which have interest rate. The risk is managed based on capital objective and risk management. This objective and policy include Pelaburan Jangka Panjang Long Term Investment 1,658,000 1,658,000

maintaining suitable combination between borrowings' interest rate and floating rate. The effective interest rate of financial instruments are as follows:- 854,098,855 - - 854,098,855

Liabiliti Kewangan Financial Liabilities

Kadar Faedah 2023 2022 Manfaat Pekerja Employee Benefits 44,977,158 44,977,158

KUMPULAN GROUP Purata Berwajaran RM RM 44,977,158 - - 44,977,158

Pada 31 Disember As at 31 December Effective Interest Rate

Simpanan Tetap, Tunai dan Baki di Bank Fixed Deposits, Cash and Bank Balances 3% 883,149,030 759,080,417 Tahap 1 Tahap 2 Tahap 3 Jumlah

UNIVERSITI UNIVERSITY Level 1 Level 2 Level 3 Total

Pada 31 Disember 2022 As at 31 December 2022

Kadar Faedah 2023 2022 RM RM RM RM

UNIVERSITI UNIVERSITI Purata Berwajaran RM RM Aset Kewangan Financial Assets

Pada 31 Disember As at 31 December Effective Interest Rate Pelaburan Dengan Pengurus Dana Fund Placed with Fund Manager 810,879,494 810,879,494

Simpanan Tetap, Tunai dan Baki di Bank Fixed Deposits, Cash and Bank Balances 3% 868,185,688 717,073,207 Pelaburan Jangka Panjang Long Term Investment 1,852,000 1,852,000

- 812,731,494 - - 812,731,494

Liabiliti Kewangan Financial Liabilities

(d) Risiko Harga Pasaran Market Rate Risk Manfaat Pekerja Employee Benefits 48,726,673 - - 48,726,673

48,726,673 - - 48,726,673

● Pelaburan Dalam Dana Ekuiti adalah terdedah kepada risiko harga pasaran disebabkan ketidaktentuan nilai masa hadapan tersebut. Pengurusan risiko harga pasaran adalah melalui

pemantauan ke atas prestasi pencapaian pulangan yang diperoleh oleh setiap Pengurus Dana. Investment in Equity Funds are exposed to the risk of market price due to the uncertainty of future (g) Pengurusan Risiko Modal Capital Risk Management

value. Risk management of market price is monitored through returns performance achievement by each of Fund Manager. Investment in Equity Funds are exposed to the risk of market price due to the

uncertainty of future value. Risk management of market price is monitored through returns performance achievement by each of Fund Manager. ● Objektif utama pengurusan modal Kumpulan dan Universiti adalah untuk memastikan terdapat tunai yang mencukupi untuk menyokong keperluan pembiayaan

Kumpulan dan Universiti, termasuk perbelanjaan modal, untuk memastikan bahawa Kumpulan dan Universiti kekal kukuh dari segi kewangan. Kumpulan dan

Universiti sentiasa memantau aliran tunainya bagi memastikan setiap komitmen Kumpulan dan Universiti dapat dipenuhi.

(e) Risiko Tukaran Mata Wang Asing Foreign Exchange Risk

~ The main objective of capital management of Group and University are to ensure that there are sufficient cash to support Group and University's financing, including capital

● Risiko Tukaran Mata Wang Asing ialah risiko yang melibatkan perubahan ke atas nilai saksama atau aliran tunai masa hadapan bagi instrumen kewangan disebabkan oleh perubahan expenditure, to ensure that the Group and University remain strong in term of financing. Group and University always monitor their cash flows to ensure every Group and University

committment are fullfilled.

dalam kadar tukaran mata wang asing. Risiko tukaran mata wang asing adalah minimum kerana transaksi di dalam mata wang asing adalah sedikit. Foreign exchange risk is a risk which

28. PELARASAN TAHUN SEBELUM PRIOR YEAR ADJUSTMENTS

involve changes over fair value or future cash flow for financial instrument caused by changes in foreign exchange rate.The foreign exchange risk is minimal due to minimum transactions in foreign exchange.

Pelarasan tahun sebelum timbul daripada pengabaian material pemiutang pada tahun kewangan 2019, 2020, 2021 dan 2022. Salah nyata itu mempunyai kesan

(f) Nilai Saksama Fair Value penurunan kerugian anak Syarikat bagi tahun kewangan berakhir 31 Disember 2022 sebanyak RM2,559,386.

● Nilai bawaan bagi semua Aset Kewangan dan Liabiliti Kewangan Kumpulan dan Universiti pada tarikh Penyata Kedudukan Kewangan adalah dianggarkan pada nilai saksama. Salah nyata telah diambil kira secara retrospektif dan kesan ke atas tahun sebelumnya telah diambil sebagai pelarasan tahun sebelumnya dalam penyata

Kaedah dan andaian berikut digunakan bagi menentukan nilai saksama. Carrying amount for all financial assets and financial liabilities of the Group and University at the statements of financial kewangan. Sehubungan itu, angka perbandingan berikut telah disusun semula untuk menunjukkan kesan perubahan:-

position date are estimated at fair value. The following method and assumptions are used to determine fair value.

The prior year adjustment arose from the material omission of payables with respect to financial years 2019, 2020, 2021 and 2022. The misstatement has the effect of decreasing the

● Nilai saksama instrumen kewangan adalah jumlah yang mana instrumen itu boleh ditukar atau diselesaikan antara pihak berpengetahuan dengan tulus selain daripada secara Company’s loss attributable to the shareholders for the financial year ended 31 December 2022 by RM2,559,386.

paksaan atau jualan pembubaran. Fair value of financial instruments are total in which the instrument can be changed or completed between knowledgeable party sincere other than through force or The misstatement has been accounted for retrospectively and the effects on the prior year have been taken up as prior year adjustment in the financial statements. Accordingly, the

liquidation sales.

following comparative figures have been restated to reflect the effects of the change: -

● Instrumen kewangan Universiti adalah terdiri daripada pelaburan, tunai dan bersamaan tunai, pelbagai siberhutang dan pelbagai sipiutang dan terakru. The University's financial Seperti dilaporkan Kesan pelarasan Seperti dinyatakan

instruments are consists of investments, cash and cash equivalent, various debtors and various creditors and accruals.

KUMPULAN GROUP sebelum ini tahun sebelum semula

● Instrumen kewangan Universiti adalah dibawa pada kos yang dilunas, yang tidak berbeza secara ketara daripada nilai saksama. The University's financial instruments are carried at amortised Pada 31 Disember 2022 As at 31 December 2022 As Previously Reported Effects of Prior Year As Restated

Adjustment

cost, not materially difference from fair value. RM RM RM

Penyata Kedudukan Kewangan pada 31 Disember 2022 (Ekstrak)

(i) Tunai dan Kesetaraan Tunai, Penghutang dan Liabiliti Semasa bersamaan dengan nilai dibawanya kerana ia mempunyai tempoh matang yang pendek. Cash and cash equivalent, Statement of Financial Position as at 31 December 2022 (Extract):

receivables and current liabilities are same as carrying value because its have short maturity period.

Ekuiti Equity

(ii) Aset atau Liabiliti Jangka Panjang pada kadar tetap dan kadar berubah dinilai oleh Kumpulan dan Universiti berdasarkan kepada parameter tertentu seperti kadar faedah. Jumlah Kumpulan wang Total Funds 2,493,274,469 (2,463,153) 2,490,811,314

Kepentingan Bukan Kawalan Non Controlling interest (767,278) (96,233) (863,512)

Berdasarkan penilaian ini, peruntukan diambilkira untuk kerugian yang timbul dari penghutang ini dan kadar faedah yang berkaitan dengan pasaran. Long term assets or liabilities at fixed

rate or variable rate are measured by the Group and University based on certain parameter such as interest rate. Based on this measurement, provision will be provided for the losses incurred from this debtors Liabiliti Semasa Current Liabilities

and interest rate related with market. Akaun Belum Bayar Payables 213,338,185 2,559,386 215,897,571

(iii) Nilai saksama pelaburan sedia dijual ditentukan dengan merujuk kepada harga pasaran. Fair value for available for sales investment are determine by referring to market price. Penyata Kedudukan Kewangan pada 31 Disember 2021 (Ekstrak)

Statement of Financial Position as at 31 December 2021 (Extract):

Aset dan Liabiliti Kewangan yang dinyatakan pada nilai saksama adalah seperti berikut: Ekuiti Equity

Financial assets and liabilities stated at fair value are as follows:- Jumlah Kumpulan wang Total Funds 2,495,131,782 (465,299) 2,494,666,483

Kepentingan Bukan Kawalan Non Controlling interest (982,079) (18,180) (1,000,259)

KUMPULAN GROUP Tahap 1 Tahap 2 Tahap 3 Jumlah Liabiliti Semasa Current Liabilities

Pada 31 Disember 2023 As at 31 December 2023 Level 1 Level 2 Level 3 Total Akaun Belum Bayar Payables 187,072,183 483,479 187,555,662

RM RM RM RM

Aset Kewangan Financial Assets Penyata Prestasi Kewangan bagi tahun berakhir 31 Disember 2022 (Ekstrak)

Pelaburan Dengan Pengurus Dana F und Placed with Fund Manager 889,141,446 - - 889,141,446 Statement of Financial Performance for the year ended 31 December 2022 (Extract):

Pelaburan Jangka Panjang Long Term Investment 1,658,002 - - 1,658,002 Lain-lain perkhidmatan yang dibeli Other services acquired

890,799,448 - - 890,799,448 315,709,782 2,075,907 317,785,689

Liabiliti Kewangan Financial Liabilities Penyata Prestasi Kewangan bagi tahun berakhir 31 Disember 2021 (Ekstrak)

Manfaat Pekerja Employee Benefits 44,977,158 - - 44,977,158 Statement of Financial Performance for the year ended 31 December 2021 (Extract):

44,977,158 - - 44,977,158

Lain-lain perkhidmatan yang dibeli Other services acquired 268,142,748 384,772 268,527,520

Penyata Kewangan 123

33 34