Page 44 - Filing Status for Individuals - Handbook

P. 44

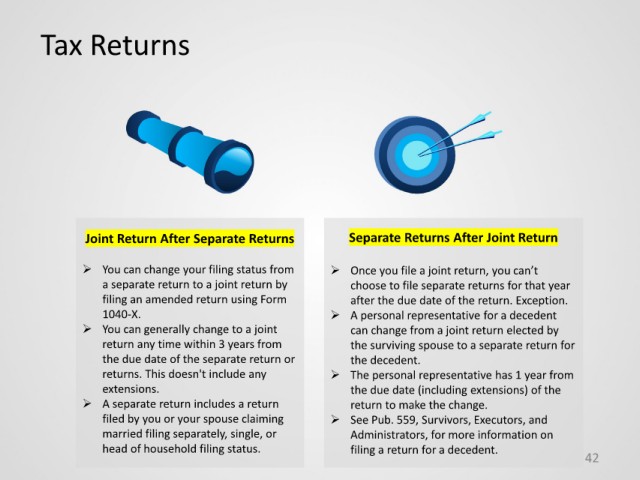

Tax Returns

Joint Return After Separate Returns Separate Returns After Joint Return

You can change your filing status from Once you file a joint return, you can’t

a separate return to a joint return by choose to file separate returns for that year

filing an amended return using Form after the due date of the return. Exception.

1040-X. A personal representative for a decedent

You can generally change to a joint can change from a joint return elected by

return any time within 3 years from the surviving spouse to a separate return for

the due date of the separate return or the decedent.

returns. This doesn't include any The personal representative has 1 year from

extensions. the due date (including extensions) of the

A separate return includes a return return to make the change.

filed by you or your spouse claiming See Pub. 559, Survivors, Executors, and

married filing separately, single, or Administrators, for more information on

head of household filing status. filing a return for a decedent.

42