Page 68 - Filing Status for Individuals - Handbook

P. 68

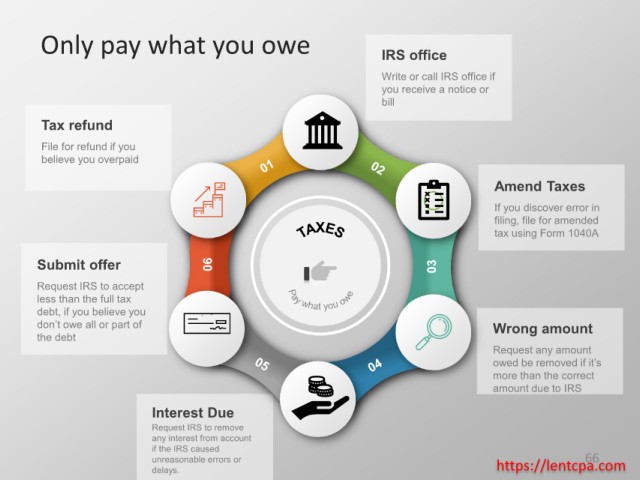

Only pay what you owe IRS office

Write or call IRS office if

you receive a notice or

bill

Tax refund

File for refund if you

believe you overpaid

Amend Taxes

If you discover error in

filing, file for amended

tax using Form 1040A

Submit offer 06 03

Request IRS to accept

less than the full tax

debt, if you believe you

don’t owe all or part of Wrong amount

the debt

Request any amount

owed be removed if it’s

more than the correct

amount due to IRS

Interest Due

Request IRS to remove

any interest from account

if the IRS caused

66

unreasonable errors or https://lentcpa.com

delays.