Page 20 - Tax Credit and Deductions for Individuals

P. 20

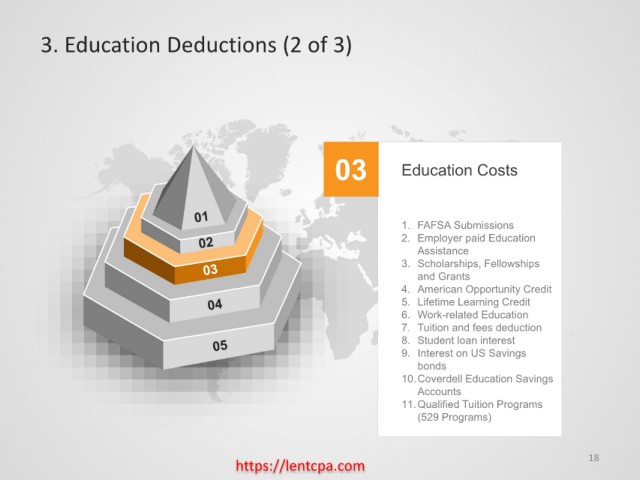

3. Education Deductions (2 of 3)

03 Education Costs

1. FAFSA Submissions

2. Employer paid Education

Assistance

3. Scholarships, Fellowships

and Grants

4. American Opportunity Credit

5. Lifetime Learning Credit

6. Work-related Education

7. Tuition and fees deduction

8. Student loan interest

9. Interest on US Savings

bonds

10.Coverdell Education Savings

Accounts

11.Qualified Tuition Programs

(529 Programs)

https://lentcpa.com 18