Page 110 - JoFA_Jan_Apr23

P. 110

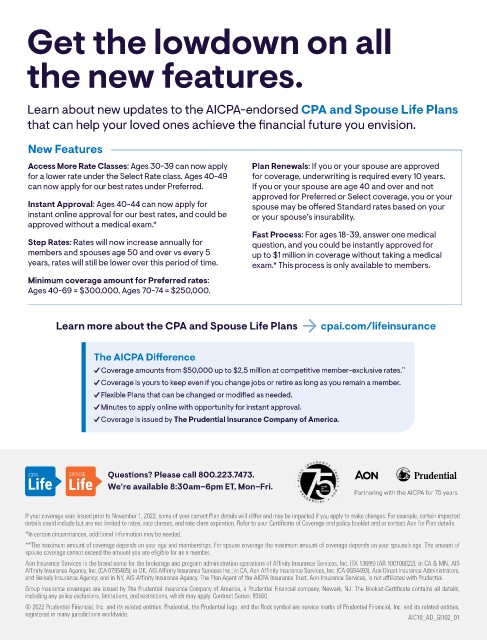

Get the lowdown on all

the new features.

Learn about new updates to the AICPA-endorsed CPA and Spouse Life Plans

that can help your loved ones achieve the financial future you envision.

New Features

Access More Rate Classes: Ages 30-39 can now apply Plan Renewals: If you or your spouse are approved

for a lower rate under the Select Rate class. Ages 40-49 for coverage, underwriting is required every 10 years.

can now apply for our best rates under Preferred. If you or your spouse are age 40 and over and not

approved for Preferred or Select coverage, you or your

Instant Approval: Ages 40-44 can now apply for spouse may be offered Standard rates based on your

instant online approval for our best rates, and could be or your spouse’s insurability.

approved without a medical exam.*

Fast Process: For ages 18-39, answer one medical

Step Rates: Rates will now increase annually for question, and you could be instantly approved for

members and spouses age 50 and over vs every 5 up to $1 million in coverage without taking a medical

years, rates will still be lower over this period of time. exam.* This process is only available to members.

Minimum coverage amount for Preferred rates:

Ages 40-69 = $300,000, Ages 70-74 = $250,000.

Learn more about the CPA and Spouse Life Plans cpai.com/lifeinsurance

The AICPA Difference

Coverage amounts from $50,000 up to $2.5 million at competitive member-exclusive rates. **

Coverage is yours to keep even if you change jobs or retire as long as you remain a member.

Flexible Plans that can be changed or modified as needed.

Minutes to apply online with opportunity for instant approval.

Coverage is issued by The Prudential Insurance Company of America.

SPOUSE Questions? Please call 800.223.7473.

We’re available 8:30am–6pm ET, Mon–Fri.

If your coverage was issued prior to November 1, 2022, some of your current Plan details will differ and may be impacted if you apply to make changes. For example, certain impacted

details could include but are not limited to rates, rate classes, and rate class expiration. Refer to your Certificate of Coverage and policy booklet and or contact Aon for Plan details.

*In certain circumstances, additional information may be needed.

**The maximum amount of coverage depends on your age and memberships. For spouse coverage the maximum amount of coverage depends on your spouse’s age. The amount of

spouse coverage cannot exceed the amount you are eligible for as a member.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS

Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators,

and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. The Plan Agent of the AICPA Insurance Trust, Aon Insurance Services, is not affiliated with Prudential.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details,

including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

© 2022 Prudential Financial, Inc. and its related entities. Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities,

registered in many jurisdictions worldwide. AIC10_AD_GI102_01