Page 174 - JoFA_Jan_Apr23

P. 174

TAX MATTERS

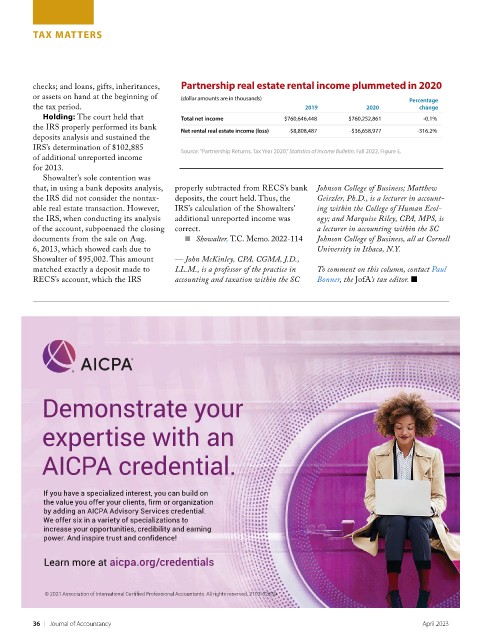

checks; and loans, gifts, inheritances, Partnership real estate rental income plummeted in 2020

or assets on hand at the beginning of (dollar amounts are in thousands) Percentage

the tax period. 2019 2020 change

Holding: The court held that Total net income $760,646,448 $760,252,861 -0.1%

the IRS properly performed its bank

Net rental real estate income (loss) -$8,808,487 -$36,658,977 -316.2%

deposits analysis and sustained the

IRS’s determination of $102,885

Source: “Partnership Returns, Tax Year 2020,” Statistics of Income Bulletin, Fall 2022, Figure E.

of additional unreported income

for 2013.

Showalter’s sole contention was

that, in using a bank deposits analysis, properly subtracted from RECS’s bank Johnson College of Business; Matthew

the IRS did not consider the nontax- deposits, the court held. Thus, the Geiszler, Ph.D., is a lecturer in account-

able real estate transaction. However, IRS’s calculation of the Showalters’ ing within the College of Human Ecol-

the IRS, when conducting its analysis additional unreported income was ogy; and Marquise Riley, CPA, MPS, is

of the account, subpoenaed the closing correct. a lecturer in accounting within the SC

documents from the sale on Aug. ■ Showalter, T.C. Memo. 2022-114 Johnson College of Business, all at Cornell

6, 2013, which showed cash due to University in Ithaca, N.Y.

Showalter of $95,002. This amount — John McKinley, CPA, CGMA, J.D.,

matched exactly a deposit made to LL.M., is a professor of the practice in To comment on this column, contact Paul

RECS’s account, which the IRS accounting and taxation within the SC Bonner, the JofA’s tax editor. ■

Demonstrate your

expertise with an

AICPA credential.

If you have a specialized interest, you can build on

the value you offer your clients, firm or organization

by adding an AICPA Advisory Services credential.

We offer six in a variety of specializations to

increase your opportunities, credibility and earning

power. And inspire trust and confidence!

Learn more at aicpa.org/credentials

© 2021 Association of International Certified Professional Accountants. All rights reserved. 2103-62839

2103-62839 Credential Ads_CMYK.indd 2 4/29/21 9:48 AM

36 | Journal of Accountancy April 2023