Page 133 - Other Income for Individuals

P. 133

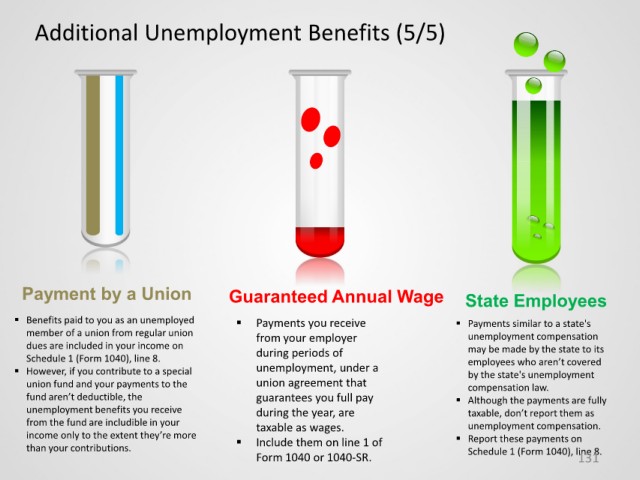

Additional Unemployment Benefits (5/5)

Payment by a Union Guaranteed Annual Wage State Employees

Benefits paid to you as an unemployed Payments you receive Payments similar to a state's

member of a union from regular union from your employer unemployment compensation

dues are included in your income on may be made by the state to its

Schedule 1 (Form 1040), line 8. during periods of employees who aren’t covered

However, if you contribute to a special unemployment, under a by the state's unemployment

union fund and your payments to the union agreement that compensation law.

fund aren’t deductible, the guarantees you full pay Although the payments are fully

unemployment benefits you receive during the year, are taxable, don’t report them as

from the fund are includible in your taxable as wages. unemployment compensation.

income only to the extent they’re more Report these payments on

than your contributions. Include them on line 1 of Schedule 1 (Form 1040), line 8.

Form 1040 or 1040-SR. 131