Page 41 - Other Income for Individuals

P. 41

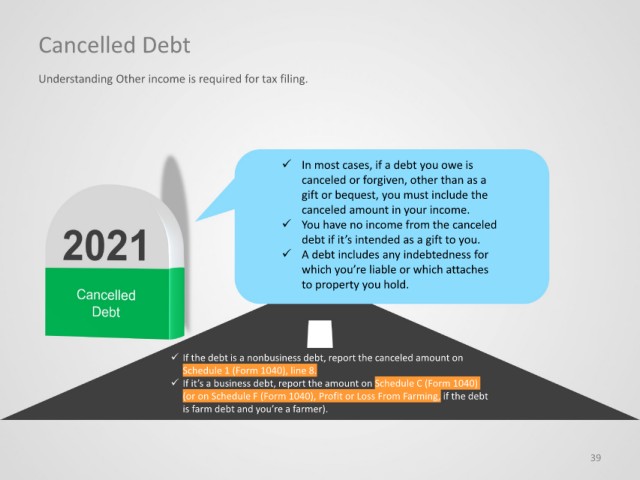

Cancelled Debt

Understanding Other income is required for tax filing.

In most cases, if a debt you owe is

canceled or forgiven, other than as a

gift or bequest, you must include the

canceled amount in your income.

You have no income from the canceled

debt if it’s intended as a gift to you.

A debt includes any indebtedness for

which you’re liable or which attaches

to property you hold.

If the debt is a nonbusiness debt, report the canceled amount on

Schedule 1 (Form 1040), line 8.

If it’s a business debt, report the amount on Schedule C (Form 1040)

(or on Schedule F (Form 1040), Profit or Loss From Farming, if the debt

is farm debt and you’re a farmer).

39